by Mark Garro | Thrifty Tips

In an economic environment where every penny counts, missteps in saving strategies can lead to financial setbacks rather than gains.

Wide Spectrum of Saving Strategies

Image Credit: Shutterstock / Monster Ztudio

The quest to save money encompasses a wide spectrum of decisions, from everyday purchases to major financial commitments. While the intent is to safeguard finances, the approach to saving can sometimes be a double-edged sword.

It’s crucial to understand the complexities and potential pitfalls across various areas to ensure that efforts to economize don’t inadvertently lead to greater expenses.

Misconceptions in Car Ownership

Image Credit: Shutterstock / peterschreiber.media

Owning an old car may seem cost-effective. However, a new car will generally not have the unexpected repairs and maintenance costs of an older car.

Consequently, the allure of no car payments is often overshadowed by the unpredictability and potential expense of maintaining an older vehicle.

Bulk Buying Pitfalls

Image Credit: Shutterstock / alphaspirit.it

Bulk purchases can seem like a smart way to save, but this isn’t always the case.

Shoppers may find that buying in large quantities can lead to unnecessary expenses and wasted resources. It is wise to be cautious of overstocking items, which might lead to financial strain and food waste.

Insurance Shortcuts Can Backfire

Image Credit: Shutterstock / Vitalii Vodolazskyi

Underinsured individuals risk financial ruin in the event of unforeseen circumstances. Brian K. Seymour, CEO of Prosperitage Wealth, emphasizes the importance of adequate coverage.

“Maintaining only the state-mandated coverage can leave you personally responsible for any damages that exceed your policy limits,” he explains, advocating for comprehensive policies.

The Cost of Selling Low-Value Items

Image Credit: Shutterstock / Andrey_Popov

There can be huge inefficiencies in selling low-value items. The effort often exceeds the financial return, suggesting that donating such items and focusing on high-value sales, like luxury goods, can be more beneficial.

DIY Home Repairs: A Risky Gamble

Image Credit: Shutterstock / Stokkete

DIY home repairs can escalate costs, especially when things go wrong. Josh Rudin of ASAP Restoration LLC warns about the dangers of amateur repairs leading to more significant issues.

He recommends hiring professionals and regularly maintaining your home to avoid costly surprises.

Dental Neglect: A Pricey Oversight

Image Credit: Shutterstock / Motortion Films

Neglecting dental health can lead to expensive treatments down the line. Michael Kosdon, DDS, advises regular checkups to avoid costly procedures.

“A checkup and cleaning is not expensive, so it’s not worth it to wait until you’re in a better financial position,” he states, highlighting the cost-effectiveness of preventative care.

The False Economy of Cheap Purchases

Image Credit: Shutterstock / goodluz

Investing in quality can save money in the long run. Cheap items often have a short lifespan, leading to frequent replacements and, ultimately, higher costs.

Similarly, underutilized services, like gym memberships, are a waste if they don’t meet your needs.

Evaluating the True Cost of Savings

Image Credit: Shutterstock / Stokkete

Before embarking on any cost-cutting measures, it’s important to assess their long-term impact.

Often, what seems like a saving in the short term can lead to higher expenses down the road.

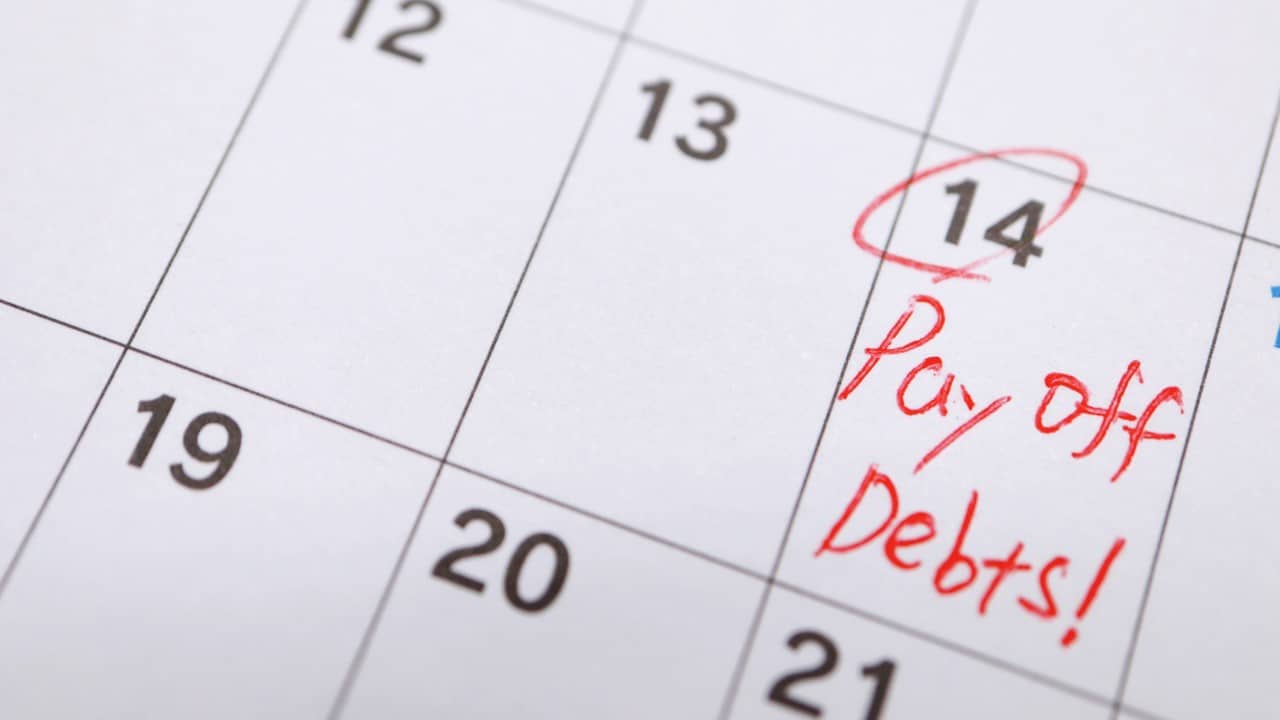

The Dangers of Overextending on Credit

Image Credit: Shutterstock / Stokkete

When bulk buying or undertaking expensive projects, the temptation to use credit can lead to debt accumulation.

Understanding the true cost of credit card interest and finance charges is essential to avoid falling into a debt trap.

Maximizing the Value of Investments

Image Credit: Shutterstock / wutzkohphoto

Whether it’s a car, home repairs, or health services, investing in quality can lead to long-term savings.

This approach minimizes the need for frequent replacements or repairs, ultimately saving money.

The Hidden Costs of DIY

Image Credit: Shutterstock / Serhii Krot

While DIY projects can be tempting, they often end up being more expensive due to a lack of expertise and proper tools.

Professional services, although initially more costly, can prevent expensive mistakes and ensure quality results.

Making Smart Choices in Healthcare

Image Credit: Shutterstock / Rosemarie Mosteller

Regular health and dental care are not just about maintaining well-being; they’re also about avoiding expensive treatments in the future.

Investing in preventive care is a cost-effective strategy.

The True Value of Time

Image Credit: Shutterstock / bleakstar

Time is a precious resource, and its value should be considered in any money-saving endeavor.

Naghibi’s advice to focus on high-value activities over time-consuming, low-return tasks is a reminder of the importance of efficient time management.

A Balanced Approach

Image Credit: Shutterstock / Sutthiphong Chandaeng

Effective money-saving strategies require a balanced approach, considering both immediate and long-term impacts.

By making informed decisions, consumers can avoid the pitfalls of misguided saving tactics and ensure their efforts lead to real financial benefits.

The post How to Dodge Costly Money-Saving Mistakes first appeared on Thrifty Guardian.

Featured Image Credit: Shutterstock / Tijana Simic.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

by Mark Garro | Thrifty Tips

How much do you have in your emergency fund? $100? $500? Or are you reading this thinking “Emergency fund? Yeah right!” Finding ways to create a savings account shouldn’t be overwhelming. I’ve got some tips and tricks to putting a little bit of cash aside so you can begin developing the emergency savings you need.

Disclosures: The links in this post may contain affiliate links through which I can receive a small commission at no additional cost to you if you make a purchase after clicking on my link.

Emergency Fund Help

First let’s start with what exactly an emergency savings is. An emergency savings is just how it sounds – funds that have been set aside to be used only in the event of an emergency. These emergencies can range everywhere from losing your job, crashing your car, or an unexpected illness that leaves you with outrageous medical bills.

It is impossible to be ready for any emergency that comes your way, but one of the best things you can do for yourself and your credit is to create an emergency fund to bail you out of any unforgiving financial situations.

If you’ve seen how I create a budget, you know that we don’t have a lot of wiggle room. Between daycare costs, student loans, mortgage – it’s hard not to live paycheck to paycheck!

When we bought our house in 2014, we obliterated our savings and then some. Despite a thorough inspection and a supposed HUD-regulated appraisal, we ran into a few issues shortly after moving in and had to pay for repairs with a credit card. A year later and $276 in interest later, I’m happy(ish) to say we’ve paid that off and no longer hold any credit card debt. If we’d had an emergency fund, though, we could have used that $276 as an additional payment on our mortgage or car loan, thereby saving us not just the $276, but whatever interest was charged on that payment that was never made.

Why a Credit Card is NOT a Savings

A credit card can be great if you use it properly. Because we do so much of our household shopping through Amazon Prime, we have an Amazon.com Rewards VISA. It’s great because we earn 3% on anything bought through Amazon plus 1-2% on everything else. We even got a $50 gift card when we signed up! The trick is making sure that we only use it on things we already have the cash for. This way we can immediately pay it off once the bill comes but we still earn cash back that we can put towards future purchases. I love going to check out on Amazon and spending next to nothing because of how quickly the rewards stack up!

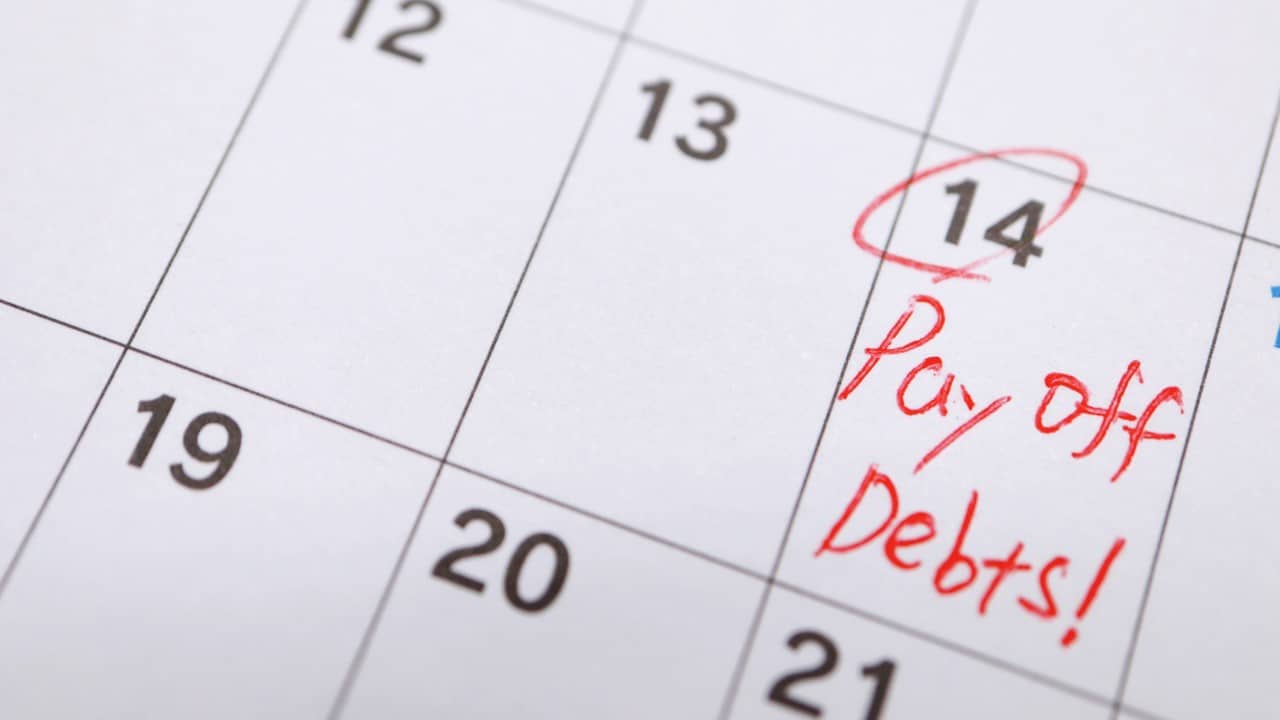

Avoiding Debt

Notice, though, that I said we only use our credit card when we already have the cash to pay it off. Whether you have the cash tucked away in the bank or you have the freedom to pull it out of a paycheck, the only time a credit card is a reliable option is if you absolutely have a way to pay it off. It is not an option as an emergency fund.If you use your credit card as a way to get yourself out of an emergency, how will you pay it when that bill comes due? For particularly expensive emergencies, that bill could sit on the credit card for months, or even years, before it is paid off and then you’re looking at hundreds, if not thousands, of dollars in interest!

The interest on credit cards can be high, and as you continue to go months and months without being able to pay your debt off, the interest will only continue to grow. If you can’t afford the emergency in the first place, you definitely can’t afford to pay more in interest than you expected. Continuously avoiding paying down credit card debt will also negatively impact your credit. If your credit score gets too low, you will have a difficult time should you need a car loan, money for college, or you want to buy a house. Emergencies are unavoidable, but you don’t want to make one worse by giving it the power to ruin the rest of your life financially.

Why Having an Emergency Fund is a Must

If you’re already living thrifty, you may think you don’t have enough cash to set aside for an emergency fund. I know, I’ve been there. When you’ve created your budget and you’ve got every penny accounted for, it’s easy to say “I KNOW I can’t afford to save…” but truthfully, you can’t afford not to.

It’s frustrating, I know. You know your finances and they already feel stretched to their limits. You may want to click away now, angry that I should so presumptuous as to say you have to start an emergency fund. But, please, stick with me for just another minute.

It adds up

Any money you can save, even if it’s just $5 a week for now, will add up eventually. Hopefully you won’t experience any emergencies any time soon, but even if you do, any actual money you have will help make a difference in what you have to put on credit.

Let’s say you have a credit card that sits at a 27% interest rate and you experience a medical emergency that costs you $2,500. With a $100 now owed each month (and that’s $100 you already said you don’t have but are now required to find), that bill will take you over three years to pay off and end up actually costing you $3,800.

If, however, you had even just $750 in savings, that same bill (while still costly) will only cost you $2,300 to be paid off in 23 months. So that $750 in savings is actually saving you more than TWICE that in the long run.

A general rule of thumb on how much to have in savings in around 6 months of living expenses; for us, that would be $19,000. I see that number and I immediately want to laugh and cry at the same time. We are no where near that $19,000 mark. In fact, I see that and I’m right there with you – it seems IMPOSSIBLE!

But then I remind myself – it doesn’t need to happen overnight. I think back to what a difference having only $750 makes and then I can breathe again.

How to Grow Your Emergency Fund

Begin saving by making a small goal, maybe one month of mortgage and utility payments. Then take a good long honest look at your budget. What can you cut out or cut back? I bet you can cut your budget by at least 5%.

Here are just a few ideas on how to cut back:

- Your cellphone plan. We were paying $160/month for our two phones until we switched to Republic Wireless. Now our bill averages $38/month. Why? Because with Republic Wireless, you only pay for what you use. For example, if you pay 2GB per month ($30) but only use 1GB, you’ll see a $15 credit on your account the following month. I love it!

- Check out my post on how to eliminate kids clothes from your budget (don’t worry, they won’t go naked!)

- Get rid of cable. I’ll admit, this one was tough for me. Not because we watch a lot of TV but because the one show we do love to watch isn’t available on Hulu or Netflix until after the season is done. Guh. So many spoilers!! But we did it anyway and I’m glad because it saves us well over $600/year.

- Have a little one in diapers? There are many ways to slash costs on those, including switching to a generic brand. Check out my best tips on how to save money on diapers!

- See if your gas company has a flat rate budgeting plan. This way you know exactly what you’ll need to pay each month versus having more money in the summer and scrambling to find it in the winter.

- Declutter your home and put any extra income you earn into your savings account!

- Consolidate your student loans and secure a lower interest rate.

- If you have credit cards, call and ask them to lower your interest rate. They might refuse, but they might not. It never hurts to ask!

- Eat breakfast. Wait, what? Yep, I said eat breakfast. Start your day off right so you’re less likely to splurge on vending machine treats or fast food for dinner.

- Do a majority of your shopping online. Not only will you save on gas, but you can often buy in bulk and save on a lot of your groceries or household goods. For example, I never buy baggies in store. At Target, they’re $4.59 for 38 (or .12 cents each). On Amazon, I got 500 for $28.36 (or .05 cents each!)

Trim the Fat

Once you decide on ways to trim, you will slowly but most certainly reach the goal you have made for yourself. It is also important for you not to view the money you set aside as a typical savings account. Only take money from this particular bank account in the event of a true emergency, which doesn’t include a new cellphone or a new car.

Begin saving by making a small goal, maybe one month of rent or mortgage payments. Set aside as much of your paycheck as you think you can do without, even if it is only a few dollars. You can also spend a bit of time each week earning some extra cash and automatically put that aside for savings. As you continue to set aside little bits, you will slowly but surely reach the goal you have made for yourself.

For many people without much disposable income, developing an emergency fund seems like something completely out of reach. While restructuring your budget can seem overwhelming or stressful at first, it’ll be well worth it in the long run. Setting aside just a few dollars a week can get you on track to a decent emergency fund and keep you from making a bad emergency even worse!

The post Emergency Fund – How to Start from Nothing first appeared on Thrifty Guardian.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

by Mark Garro | Career & Education, Thrifty Tips

As we step into 2024, the career landscape is evolving rapidly, presenting new and exciting opportunities for those aiming to maximize their earning potential. Whether you’re a student planning your future or a professional looking to pivot, this guide will provide valuable insights into each career path.

#1. AI Engineer

Image Credit: Shutterstock / Amorn Suriyan

AI Engineers develop artificial intelligence systems, working on algorithms, machine learning models, and deep learning techniques to simulate human cognition.

Getting Started: Gain hands-on experience through internships and projects. Stay updated with the latest AI technologies and trends.

Average Salary: Approximately $136,620.

Upside: Involvement in cutting-edge technology and high demand.

Downside: Rapidly evolving field requiring continual learning.

#2. Air Traffic Controller

Image Credit: Shutterstock / Gorodenkoff

Air Traffic Controllers manage aircraft movements on the ground and in the air, ensuring safe distances between planes.

Getting Started: Develop strong communication and decision-making skills. Physical and mental health is crucial for this high-stress job.

Average Salary: Around $132,250.

Upside: High responsibility and job security.

Downside: Extremely stressful and demanding work environment.

#3. Medical Dosimetrist

Image Credit: Shutterstock / ORION PRODUCTION

Medical Dosimetrists plan and calculate radiation doses for cancer patients, working closely with oncologists and radiologists.

Getting Started: Gain experience in radiation therapy and a strong background in sciences. Attention to detail is critical.

Average Salary: Approximately $128,970.

Upside: Critical role in cancer treatment with significant impact.

Downside: Emotionally challenging and requires precise attention to detail.

#4. Computer Network Architect

Image Credit: Shutterstock / Gorodenkoff

These professionals design and build data communication networks, including local area networks (LANs), wide area networks (WANs), and intranets.

Getting Started: Acquire certifications like CCNA or CCNP and gain practical experience in networking.

Average Salary: About $126,900.

Upside: Central role in maintaining and upgrading essential network infrastructures.

Downside: Need to be on-call for emergencies or system failures.

#5. Software Developer

Image Credit: Shutterstock / puhhha

Software Developers create and maintain applications or systems software, often working in teams to solve complex problems.

Getting Started: Build a portfolio of work, contribute to open-source projects, and develop strong problem-solving skills.

Average Salary: Around $124,200.

Upside: Creative and constantly evolving environment.

Downside: Can involve long hours and tight project deadlines.

#6. Actuary

Image Credit: Shutterstock / Adam Gregor

Actuaries analyze financial risk using mathematics, statistics, and financial theory, primarily in the insurance and finance sectors.

Getting Started: Gain practical experience through internships and work on developing strong analytical skills.

Average Salary: Approximately $113,990.

Upside: Important role in risk assessment and financial planning.

Downside: A demanding field with a rigorous exam process.

#7. Sales Engineer

Image Credit: Shutterstock / kckate16

Sales Engineers combine technical knowledge with sales skills to provide advice and support on a range of products.

Getting Started: Develop strong technical and interpersonal skills. Understanding customer needs and technical acumen is key.

Average Salary: Median salary around $108,530.

Upside: Opportunities for high commissions in addition to the base salary.

Downside: Performance-based stress and irregular working hours.

#8. Industrial Production Manager

Image Credit: Shutterstock / Gorodenkoff

These managers oversee the production of goods in industries, ensuring efficiency, product quality, and safety.

Getting Started: Gain experience in production or operations management and develop leadership skills.

Average Salary: Around $107,560.

Upside: Central role in production efficiency and management.

Downside: High-pressure environment with responsibility for meeting production targets.

#9. Financial Analyst

Image Credit: Shutterstock / pics five

Financial Analysts assess the performance of investments, companies, or industries to guide business decisions.

Getting Started: Networking and internships in finance sectors are crucial. Strong analytical skills and understanding of financial markets are key.

Average Salary: About $96,220.

Upside: In-depth involvement in financial planning and investment strategies.

Downside: Can involve long hours and high stress during financial market volatility.

#10. Management Analyst

Image Credit: Shutterstock / fizkes

Management Analysts, or consultants, propose ways to improve an organization’s efficiency, advising managers on various strategies.

Getting Started: Gain experience in a related field and strong problem-solving skills. Networking and MBA can be advantageous.

Average Salary: Approximately $95,290.

Upside: Opportunity to influence organizational efficiency and strategy.

Downside: Often involves tight deadlines and high expectations from clients.

Embarking on a career journey in 2024 requires more than just academic qualifications; it demands adaptability, continuous learning, and a keen eye for emerging trends.

Remember, each career path has its unique set of challenges and rewards. As you consider these lucrative opportunities, weigh the pros and cons carefully and align them with your personal goals and values. The future is bright for those who are prepared to embrace change and seize the opportunities that lie ahead in these dynamic fields.

The post 2024’s High-Paying Jobs: What They Are and How to Get Them first appeared on Thrifty Guardian.

Featured Image Credit: Shutterstock / UfaBizPhoto.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice. For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.

by Mark Garro | Thrifty Tips, Your Money

Living paycheck to paycheck isn’t ideal, yet that doesn’t stop 62% of Americans from living in that matter. If you constantly feel you can’t keep your head above water financially, it’s time to look in the mirror. All people living paycheck to paycheck are guilty of these financial blunders; how many apply to you?

#1. Only Making Minimum Payments

Image Credit: Shutterstock.

Unfortunately, although making minimum payments on your bills is admirable, you’re ultimately doing yourself no favors. Minimum payments still incur hefty interest fees; in many cases, the interest accrued is more than the minimum payment itself! To truly pay off bills responsibly, you should devise ways to pay off your balances in full (or, at the very least, make more than the recommended minimum payment).

#2. Too Many Subscriptions

Image Credit: Shutterstock.

Let’s face it: In 2023, most of us subscribe to way too many services. From Netflix and Hulu to Spotify and Apple Music (and everything in between), countless services effortlessly take tiny monthly fees from us. In fact, this could very well contribute to our bleak financial situation! If you are struggling paycheck to paycheck, one of the first things you should do is take stock of what you’re subscribed to and make cuts wherever possible.

#3. Societal Pressure

Image Credit: Shutterstock.

Keeping up with society’s trends is exhausting; status symbols are everywhere, and unfortunately, they all cost significant money! However, “Keeping up with the Joneses” is a financial pratfall that wreaks havoc on millions of people’s bank accounts! Ask yourself, do you need to upgrade your smartphone every year? Do you need to be seen driving the newest cars while running errands? In most cases, the answer to these questions is resounding, “No.”

#4. Lack of Planning

Image Credit: fizkes/Shutterstock.

Unfortunately, many people don’t have the foresight to adequately prepare their financial futures for success, resulting in them living paycheck to paycheck. It’s a sad state of affairs; too many men and women prefer to ignore warning signs and live in a state of willful ignorance instead of setting themselves up to be financially successful! A lack of planning is one of the main reasons Americans are struggling in 2023.

#5. No Emergency Fund

Image Credit: Shutterstock.

Believe it or not, I consider living paycheck to paycheck an emergency. It’s one of the most dire financial situations a person can find themselves in (even if it doesn’t always feel that way). What would come in handy in this situation? That’s right, an emergency fund! An emergency fund exists primarily to relieve pressure; it’s a “break in case of emergency” fund that can mean the difference between considering bankruptcy or finally getting your head above water.

#6. Late Bill Payments

Image Credit: Shutterstock.

I can’t overestimate how important it is to pay bills on time. Not only does it negatively impact your credit score, but it instills a lack of urgency on consumers. Sure, you won’t get arrested for paying a bill past its due date, but the result is arguably just as catastrophic. If you consistently pay bills late, consider taking out a small personal loan to get back on track. Otherwise, you’ll find it near-impossible to stop the paycheck-to-paycheck lifestyle.

#7. Impulse Buying

Image Credit: Shutterstock.

Tiny, near-imperceptible impulse purchases go a long way to ensuring anybody will stay living paycheck to paycheck. Nobody needs Starbucks every morning; nobody needs to grab a soda or energy drink every time they fill their vehicle with gas. By cutting back on impulse buying, you’ll find significantly more money in your account, leading to getting yourself out of the vicious cycle.

#8. Not Knowing Your Worth

Image Credit: Shutterstock.

It’s sometimes too easy to be complacent with jobs and work, but not knowing your worth severely restricts your earning potential! Your occupation (and pay grade) may be to blame if you constantly live paycheck to paycheck. If you have unique skills or traits that make money for your company, demand proper compensation that reflects your impact.

#9. Predatory Automobile Loans

Image Credit: Shutterstock.

While automobile loans are a necessary evil in today’s society, getting suckered into a predatory loan helps keep even the most sensible person underwater. Living paycheck to paycheck is exceedingly difficult when you are saddled with a substantial monthly car payment (paired with a sky-high interest rate, of course). Getting yourself into a more sensible mode of transportation will help ease the financial burden.

#10. Laziness

Image Credit: Shutterstock.

Being lazy is a harsh accusation, but it’s fair in the financial literacy world. It’s easy not to care about your financial situation. It’s easy to “kick the can down the road” and ignore your responsibilities, but trust me, they will eventually catch up to you! Being lazy isn’t a temporary trait; training yourself to be proactive will take discipline. Sadly, living paycheck to paycheck is a byproduct of being lazy.

#11. Ignoring Your Bank Accounts

Image Credit: Shutterstock.

When I was younger, I was one of countless 20-somethings who refused to look at their bank accounts. It was an “out of sight, out of mind” situation, and I knew I wasn’t alone in my strategy. My bank account was always so low that I knew looking at it would ruin my day. But honestly, ignoring your problems never solves them, and the day I started facing my bank accounts head-on was when I began living more fruitfully than paycheck to paycheck!

#12. Not Paying Yourself

Image Credit: Shutterstock.

Many believe the key to getting out of the paycheck-to-paycheck grind is paying yourself! What this means is straightforward: Every time you receive a paycheck or income, transfer a pre-determined percentage to another account. The transfer amount doesn’t necessarily have to be significant; smaller amounts tend to fly under the radar, and over time, your separate “pay yourself” account will grow surprisingly! Before you know it, you’ll have a backup account with enough money to get yourself out of the rut.

#13. Credit Card Recklessness

Image Credit: Shutterstock.

Interestingly, 80% of consumers who live paycheck to paycheck have at least one credit card, with many having two or more. Responsible credit card use is easier said than done; if you pay off your total credit card balance monthly, you’re golden. However, suppose you let your balance increase over time. In that case, you’ll incur devastatingly high fees that will do you zero favors. If you’re struggling financially, determine whether you’re being reckless with everyday credit card spending.

#14. Ignoring Budgets

Image Credit: Shutterstock.

Blowing through weekly, monthly, or yearly budgets is a perfect example of a lack of discipline to succeed financially. Remember, budgets exist for a reason! Putting your expenses and associated income down on paper should give you a clearer perspective on your financial situation; ignoring these figures will spell disaster.

#15. Zero Savings

Image Credit: Shutterstock.

If you neglect your savings account, you’re ostensibly neglecting your future, so in theory, it shouldn’t surprise anyone that you’re living paycheck to paycheck. Putting aside small amounts of cash monthly toward a savings account shows forward-thinking, accountability, and financial savviness! Many regard their savings account as a safety net and report feeling greater peace of mind when their accounts are plump with cash! (Who wouldn’t?)

The post Avoid These 15 Money Missteps to Fast-Track Your Finances first appeared on Thrifty Guardian.

Featured Image Credit: Shutterstock / Just Life.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

by Mark Garro | Thrifty Tips, Your Money

The word retirement can excite pure bliss or financial dread. Are you ready to enjoy a peaceful life, basking in all you have accomplished, or are you worried about the money you have saved? A lot of retirees are not ready financially for the change, but luckily, there are some resources for those in need.

#1. Not Setting Goals

Image Credit: Shutterstock.

Any good plan should have a set of goals as its backbone. Write out your financial objectives and set specific goals you wish to hit daily, monthly, quarterly, and yearly. It’s okay if you are not perfect every day, but a solid backbone for your plan will keep you honest and allow you to notice trends in your goals. If the goals seem too far-fetched and are not being hit, adjust them accordingly.

#2. Racking up Credit Card Debt

Image Credit: Shutterstock.

Debt can grow rapidly and can be a burden on your daily life if not handled correctly. Don’t be frightened if you have amassed some credit card debt; many Americans have. What to do next is understand your credit card debt. Which accounts have the highest interest rates, and can they be combined to pay off quickly? Pay more than the minimum payment to get those balances as low as possible.

#3. Ignoring a Budget

Image Credit: Shutterstock.

As mentioned before, setting your financial goals is extremely important. The same goes for setting a budget. A budget should align with your goals and your income/outcome of money. Stick to your budget could be some of the best advice a financial advisor can give you.

#4. Impulses Buy

Image Credit: Shutterstock.

What is the one thing that can kill your monthly budget? An impulse buy, of course. I know it sounds nice to treat yourself every once in a while, but if you are focused on getting your finances in order, impulse buys can be deadly. Instead of buying the newest video game console or going on a spending spree at the mall, focus on how that will impact your budget and progress.

#5. Ignoring Credit Score

Image Credit: Shutterstock.

Your credit score could be like a little rain cloud, following you around all day, or it could be a guiding light, delivering you to financial freedom. Your credit score can be your ticket for lenders to lend you money for a new house or new car. Keeping balances low and paying your bills on time are factors in your score. Monitor it and monitor it well. It can also be vital to preventing identification fraud.

#6. Buying New Instead of Used

Image Credit: Shutterstock.

Everyone wants the new shiny toy that’s sitting on the car lot, but sometimes that could be more practical. If you have a paid-off car that is a few years older, it might be better to drive that car instead of taking out a loan for a new one. Cars generally don’t appreciate, so it is often not a wise investment.

#7. Lack of Investing

Image Credit: Shutterstock.

The word investment can be intimidating. I know it is for me. That’s why there are professionals out there to help you. Please only invest some of your money guessing on volatile stock markets by seeking professional help. These people are here to guide you to a wealthy life and usually only succeed if you do.

#8. DIY Retirement Plans

Image Credit: Shutterstock.

As I mentioned, nowadays, you don’t have to risk all your savings for retirement investing. Stop shooting in the dark trying investment plans that a friend of a friend told your brother’s mechanic while waiting in line at the store. Would you take engine advice from an accountant? No! Then why let someone without any experience (yea, I’m talking to you) control your retirement?

#9. Emergency Funds

Image Credit: Shutterstock.

Financial experts have been telling Americans that having an adequate savings account dedicated to emergencies should always be kept. Put this money away in a savings account, and don’t touch it. Please keep it for when it is needed, like for emergencies. Hopefully, it will never be needed, but it is nice to know it’s there.

#10. Lack of Insurance

Image Credit: Shutterstock.

Insurance is an important commodity to have. You never know what life can throw at us. Imagine a tree falling into your home, and you are stuck with the bill because you skimped out on the insurance. It’s better to fork out the money once a month than to have a freak accident come along and whip you out financially.

#11. Frivolous Spending

Image Credit: Shutterstock.

Frivolous spending is a lot different than impulse buying. Impulse buying is a big purchase, usually without researching. When I say frivolous spending, I mean a stop at the coffee shop every day, going out to eat every day, and other silly spending habits. A nice latte could be a rewarding treat, but keep track of how much that adds up to overtime.

#12. Not Paying Attention to Rates

Image Credit: Shutterstock.

Do you know what your basic savings account interest rate is? Don’t worry; neither did I for a long time. I’m far from retiring, but it is essential to look at and be aware of these rates. They are easy ways to make money while just sitting there. Talk to your bank and see what rates they have on their accounts. Make your money while you watch it grow!

#13. Sitting on a Lump Sum of Cash

Image Credit: Shutterstock.

Speaking of making your money make you more money, sitting on a large sum of money might seem smart, but it could be doing so much more. If you have a big credit card debt but have the money to pay it off, you’re silly for not doing so. You are just accumulating more debt. Keep your emergency fund stocked up, pay off some debt, and put the rest into some high-yielding savings accounts we discussed.

#14. Relying on Cash Advances

Image Credit: Shutterstock.

Don’t fall into the trick of thinking you are getting free money with a cash advance. Oftentimes, these have incredibly high interest rates that can only do harm instead of good. Pay it off as quickly as possible if you decide to use one. Avoid the crutch these advances have, and instead, focus on changing your budget to accommodate the need. Also, this is what your emergency fund should be used for.

#15. Start Saving First

Image Credit: Shutterstock.

The problem many people have with putting money away is they end up paying all their bills, going about their monthly spending, and then saving what is left over. Big problem: often, there is little left for savings. Experts agree that if you want to save 15% a month, it is better to do that at the beginning of the month. These factors come full circle with the importance of a proper budget.

The post The 15 Retirement Mistakes That Could Jeopardize Your Security first appeared on Thrifty Guardian.

Featured Image Credit: Pexels / MART PRODUCTION.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

by Mark Garro | Career & Education, Thrifty Tips

As we step into a new year, many are contemplating career changes, seeking opportunities that not only fulfill their passions but also offer financial stability. In 2023 several jobs witnessed significant salary hikes making them a game-changer for job seekers.

Resilient Job Market Fuels Wage Growth

Image Credit: Shutterstock / Pressmaster

The pandemic’s impact on the economy had a silver lining – it led to some of the most substantial pay increases in recent years.

Despite soaring living costs, real weekly earnings for the typical U.S. worker saw just a 1.7% rise from 2019 to 2023. However, this trend was underpinned by a robust job market, with certain roles experiencing notable wage increases.

Survey Shed Light on Soaring Salaries

Image Credit: Shutterstock / Pickadook

A recent survey conducted by compensation data firm Payscale provides valuable insights.

Analyzing responses from over 3,500 workers across 15 job titles, the survey highlights the ten roles that enjoyed the most significant wage growth in 2023.

Customer Service Leaders Lead the Pack

Image Credit: Shutterstock / Bojan Milinkov

Assistant managers in customer service roles topped the list with a remarkable 24% wage growth, reaching a median pay of $44,200.

This surge is attributed to labor shortages and high turnover rates in these demanding positions, compelling employers to raise wages to retain talent.

Hairstylists Bounce Back

Image Credit: Shutterstock / Drazen Zigic

Post-pandemic, hairstylists witnessed a 22% wage increase, with a median pay of $34,300.

The bounce back in salon services demand post-pandemic layoffs significantly contributed to this growth.

Plumbers’ Earnings Flow Upwards

Image Credit: Shutterstock / KOTOIMAGES

Master plumbers, often more skilled than journeyman plumbers, saw a 21% increase in wages, earning a median of $82,700.

This rise is linked to an uptick in home improvement projects as DIY enthusiasm waned.

Auto Body Repairers in High Gear

Image Credit: Shutterstock / il21

Automotive body repairers enjoyed a 21% wage boost, with a median pay of $52,100.

The retirement and career shifts of many workers, coupled with the increasing need for specialists for older cars, fueled this growth.

Coaching for Career Growth

Image Credit: Shutterstock / fizkes

The relatively new field of job coaching saw a 21% increase in wages, settling at a median of $46,600.

Growing concerns about labor market changes and the advent of AI technology have driven demand for career coaching services.

Audio/Visual Techs Tune into Higher Pay

Image Credit: Shutterstock / socrates471

Audio/visual technicians experienced a 20% wage growth, reaching a median pay of $57,100.

The scarcity of skilled workers and a revival in the events industry, along with the popularity of podcasting and vlogging, contributed to this rise.

Animation Industry’s Rising Stars

Image Credit: Shutterstock / Frame Stock Footage

Animators enjoyed a 19% salary increase, with a median pay of $71,400.

The scarcity of trained professionals and rapid promotions in this field left many entry-level positions vacant, driving up wages.

Fitness Coaches Flex Earning Muscles

Image Credit: Shutterstock / TORWAISTUDIO

The fitness industry saw a 19% wage growth for fitness coaches, reaching a median pay of $51,100.

The post-pandemic health consciousness and the desire to lose pandemic weight have spiked the demand for fitness professionals.

Roofers Climb the Wage Ladder

Image Credit: Shutterstock / LesPalenik

Roofers’ wages increased by 19%, with median pay hitting $51,700.

Efforts to make this physically demanding job more appealing and the uptick in weather-related damages have pushed up wages.

General Managers Remain in High Demand

Image Credit: Shutterstock / Ira Lichi

General managers saw an 18% wage increase, with a median salary of $70,700.

The long-standing shortage of individuals with comprehensive management skills continues to make this role highly sought after.

Reflecting on Wage Increases

Image Credit: Shutterstock / Jirsak

These wage hikes reflect a dynamic job market where certain skills are increasingly valued.

For those contemplating a career switch or just starting their professional journey, these insights can be pivotal in making informed decisions.

Understanding the Market Dynamics

Image Credit: Shutterstock / Andrey_Popov

It’s essential to comprehend the forces driving these wage increases.

From labor shortages to evolving industry demands, various factors contribute to the fluctuating salary scales in different sectors.

Strategies for Job Seekers

Image Credit: Shutterstock / Andrey_Popov

For those eyeing these lucrative roles, it’s vital to equip themselves with the necessary skills and understand the industry trends.

Networking, upskilling, and staying informed can significantly enhance one’s chances of landing these high-paying jobs.

The Future of Work

Image Credit: Shutterstock / shisu_ka

Understanding where the opportunities lie can be the key to not just a successful career but also a fulfilling one.

These top-paying roles offer a glimpse into the sectors where demand is surging, paving the way for those ready to embrace new challenges in the job market.

The post Where to Find Careers with Soaring Paychecks first appeared on Thrifty Guardian.

Featured Image Credit: Shutterstock / Bojan Milinkov.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.