by Thrifty Guardian | Your Money

Grocery shopping is a routine task for most of us, but many don’t realize the array of strategies grocery stores use to encourage customers to spend more. These tactics are often subtle, playing on human psychology and habits. Knowing these tricks can help you shop smarter, save money, and resist unnecessary purchases.

#1. Strategic Layout

Image Credit: Shutterstock.

The store layout is carefully designed to lead customers through a specific path, exposing them to a wide range of products. Essentials like dairy and bread sit at the back of the store, so you have to walk past all the tempting items before reaching what you need.

#2. Eye-Level Product Placement

Image Credit: Shutterstock.

The most expensive items sit at eye level. Brands often pay for this prime shelving space because it increases the likelihood of you seeing and purchasing their products. Cheaper alternatives typically end up on higher or lower shelves.

#3. Impulse Buy Items at Checkout

Image Credit: Shutterstock.

The checkout area is lined with small, tempting items like candy, gum, and magazines, encouraging last-minute impulse buys while you wait in line. These are often high-margin items that you might not have planned to purchase.

#4. Sale Signs with Limits

Image Credit: Shutterstock.

Sales signs that include phrases like “limit 5 per customer” create a sense of scarcity and urgency, prompting you to buy more than you initially intended, even if you don’t need that much of the product. Most of us immediately respond to this kind of scarcity mindset tactic.

#5. Sampling Stations

Image Credit: Shutterstock.

Free samples make you feel like you’re getting a bonus and entice you to buy products you wouldn’t have considered otherwise. Trying a product can create a sense of obligation to purchase it.

#6. Larger Shopping Carts

Image Credit: Shutterstock.

Grocery stores provide large shopping carts, subtly encouraging you to fill them up. A bigger cart makes it seem like you have fewer items, tempting you to keep adding more to your cart.

#7. Frequent Layout Changes

Image Credit: Shutterstock.

Stores frequently change their layouts to disrupt your shopping routine. This forces you to search for items, increasing the chances you’ll make unplanned purchases along the way.

#8. The Bakery Effect

Image Credit: Shutterstock.

The smell of fresh bread or pastries from the in-store bakery can stimulate your appetite, making you more likely to buy baked goods and other food items.

#9. Background Music

Image Credit: Shutterstock.

Slow, calming music is often played in grocery stores to keep you in the store longer. The longer you stay, the more likely you are to make additional purchases.

#10. High-Profit Items at Checkout

Image Credit: Shutterstock.

Aside from impulse buys, items placed near the checkout are often high-profit products. While waiting in line, you’re more likely to notice and consider these items.

#11. Bright Lighting and Colors

Image Credit: Shutterstock.

Stores use bright lighting and vibrant colors to make products look more appealing. Fresh produce is often bathed in bright light to enhance its appearance, making fruits and vegetables look fresher and more enticing.

#12. Bundled Deals

Image Credit: Shutterstock.

Bundled deals, like “buy one, get one free,” are enticing but lead you to buy more than you need. You’ll usually see these deals on products with a high markup.

#13. End Cap Displays

Image Credit: Shutterstock.

End caps – the displays at the end of each aisle – feature promotional items and are highly visible. These products are usually not the best deals but the strategic placement catches your attention.

#14. Limited-Time Offers

Image Credit: Shutterstock.

Limited-time offers are compelling, as they create a sense of urgency, pushing you to buy products immediately for fear of missing out on a good deal, even if you don’t need the item right away. Humans are suckers for FOMO.

#15. Kid-Friendly Products at Kid Eye-Level

Image Credit: Shutterstock.

Products marketed to children, like sugary cereals and snacks, are placed at kids’ eye level. This encourages children to ask their parents for these items, leading to pressure to purchase.

#16. Upselling Through Packaging

Image Credit: Shutterstock.

We’re lead to believe that larger packages or multi-packs offer better value, but unit prices may reveal that smaller packages are actually more cost-effective. This upselling technique can lead to overbuying, so be sure to check the price per unit, not just per package.

#17. Seasonal Displays

Image Credit: Shutterstock.

Seasonal displays, especially during holidays, are designed to evoke festive feelings and encourage you to buy special holiday items, many of which are unnecessary or more expensive than their non-festive counterparts.

#18. Store-Brand Placement

Image Credit: Shutterstock.

Store brands often sit next to name brands, with subtle indications that they offer similar quality for a lower price, encouraging you to switch to the often higher-margin store brand. But this isn’t always a bad thing. Often, store-brand products do offer better value than name brand counterparts.

#19. Decoy Pricing

Image Credit: Shutterstock.

Stores sometimes use decoy pricing, where a more expensive item sits next to a slightly cheaper one, making the cheaper item seem like a better deal, even if it’s not the most cost-effective option.

#20. Complex Pricing

Image Credit: Shutterstock.

Complex pricing strategies, like “10 for $10,” can be misleading. You might not need to buy 10 to get the deal, but the phrasing encourages buying in bulk.

#21. Reward Programs

Image Credit: Shutterstock.

Reward programs create a sense of loyalty and incentivize you to make more purchases, often leading you to buy items you wouldn’t have otherwise just to earn points or discounts.

#22. Complementary Product Placement

Image Credit: Shutterstock.

Complementary items, like chips near salsa or marshmallows near hot chocolate, are strategically placed to encourage you to buy both. This tactic plays on the idea of creating a complete meal or experience.

#23. Health and Wellness Claims

Image Credit: Shutterstock.

Products with health and wellness claims are usually more expensive than similar products without those claims. Stores strategically place and market these items to appeal to health-conscious consumers, even if similar, cheaper alternatives are available.

#24. In-store Cafés and Eateries

Image Credit: Shutterstock.

Some stores have in-store cafés or eateries, encouraging you to linger longer. The longer you stay, the more likely you are to make additional purchases, especially if you’re eating and drinking there.

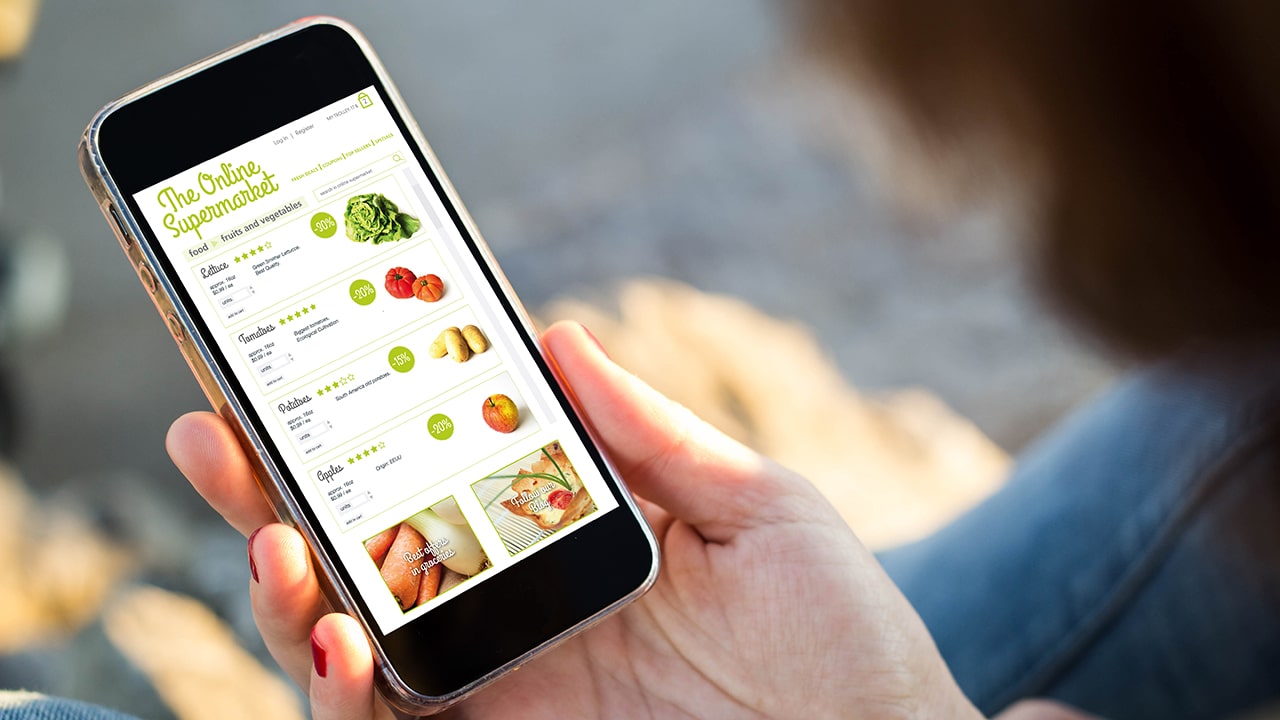

#25. Mobile Apps and Notifications

Image Credit: Shutterstock.

Grocery store apps and notifications offer convenience but also serve as a constant reminder and prompt to visit the store or check out deals, increasing the likelihood of unplanned purchases.

The post Clever Ways to Cut Your Grocery Costs first appeared on Thrifty Guardian.

Featured Image Credit: Shutterstock / goffkein.pro.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

by Thrifty Guardian | Your Money

Seniors are often the target of financial scams due to perceived vulnerabilities, such as being less familiar with digital technology or having retirement savings. Scammers exploit these factors, leading to significant financial and emotional distress for the victim.

Look at these 15 common money scams targeting seniors and practical advice on staying safe. Awareness and caution are vital in protecting yourself or your loved ones from these deceptive practices.

#1. Medicare/Health Insurance Scams

Image Credit: Shutterstock.

Scammers pose as Medicare representatives to gather personal information or sell bogus health insurance. They might call or email, claiming to need your information for a new card or offering unnecessary services for a fee. Protect yourself by never sharing personal information with unsolicited callers or messages over the phone or email.

#2. Counterfeit Prescription Drugs

Image Credit: Shutterstock.

Online pharmacies may offer cheaper prices, but many sell counterfeit or unsafe medications. These scams cost you money and can also be dangerous to your health. Always buy medication from reputable pharmacies and consult your doctor before trying new medications.

#3. Funeral and Cemetery Scams

Image Credit: Shutterstock / fizkes

Scammers read obituaries and exploit grieving widows or family members, claiming the deceased had outstanding debts with them. In another variation, disreputable funeral homes inflate prices or charge for unnecessary services. Ensure you’re dealing with reputable funeral service providers and thoroughly review any contracts or agreements.

#4. Fraudulent Anti-Aging Products

Image Credit: Shutterstock / Inside Creative House

Bogus anti-aging products are marketed aggressively to seniors, promising unrealistic results. These can be expensive and ineffective, playing on the fears of aging. Be skeptical of products that promise miraculous results and check with healthcare professionals before using them.

#5. Telemarketing/Phone Scams

Image Credit: Shutterstock / Ingo Bartussek

One of the most common scams involves telemarketers offering fake products or services, such as extended warranties, overpriced goods, or charitable donations. Never give out personal information or credit card details over the phone to unsolicited callers.

#6. Internet Fraud

Image Credit: Shutterstock / fizkes

This includes email phishing scams and bogus websites. Seniors may receive emails that appear to be from legitimate companies or institutions asking for personal information. Always verify the authenticity of requests and avoid clicking on suspicious links.

#7. Investment Schemes

Image Credit: Shutterstock.

These schemes promise high returns with little or no risk. Seniors looking to grow their retirement savings are particularly vulnerable. Be wary of unsolicited investment advice and consult a trusted financial advisor before investing.

#8. Homeowner/Reverse Mortgage Scams

Image Credit: Shutterstock.

Scammers target homeowners, particularly those with reverse mortgages. They might offer fake property assessments or pressure you into unnecessary home improvements. Always verify the credentials of anyone offering such services and seek independent advice.

#9. Sweepstakes & Lottery Scams

Image Credit: Shutterstock.

Seniors receive notifications that they’ve won a lottery or sweepstakes but need to pay a fee to unlock the prize. Remember, legitimate lotteries do not require payment to collect winnings.

#10. The Grandparent Scam

Image Credit: Shutterstock.

Scammers call seniors, pretending to be a distressed grandchild needing money immediately. Always verify the caller’s identity and check with other family members before sending money.

#11. Charity Scams

Image Credit: Shutterstock.

These scams involve soliciting donations for fake charities, especially after natural disasters or during holiday seasons. Donate to established, well-known charities, and avoid giving out personal information to cold callers.

#12. Utility Scams

Image Credit: Shutterstock.

Scammers pose as utility company representatives, threatening to shut off service unless immediate payment is made. If you receive such a call, hang up and contact your utility company directly using the number on your bill.

#13. IRS Impersonation

Image Credit: Shutterstock / fizkes

Callers claim to be IRS agents and demand immediate payment for unpaid taxes, often threatening legal action. The IRS will never call demanding immediate payment without first sending a bill in the mail.

#14. Computer Tech Support Scams

Image Credit: Shutterstock.

Scammers claim to be tech support from a well-known company and insist that your computer has a virus. They ask for remote computer access or payment to fix it. Never give remote access to your computer to unsolicited callers.

#15. Romance Scams

Image Credit: Shutterstock.

Seniors looking for companionship may fall victim to romance scams, where scammers create fake online profiles, build relationships, and eventually ask for money. Be cautious with online relationships, and never send money to someone you haven’t met in person.

The post Common Financial Tricks Targeting Seniors first appeared on Wealthy Living.

Featured Image Credit: Shutterstock / Ruslan Huzau.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

by Thrifty Guardian | Your Money

Effective budgeting is a cornerstone of financial stability, yet many people find themselves struggling due to common budgeting errors. These mistakes can hinder your ability to save, invest, and even meet your daily financial needs. If you’re aware of these common pitfalls, you can avoid them, so your finances stay on track.

#1. Not Having a Budget at All

Image Credit: Shutterstock.

The most fundamental mistake is not having a budget. You need a clear understanding of how much you earn and how much you spend, otherwise managing your finances effectively is nearly impossible. Get started by tracking all your expenses and income to create a realistic budget.

#2. Underestimating Expenses

Image Credit: Shutterstock.

Underestimating your outgoings leads to budget shortfalls. Be sure to track your spending over several months to get an accurate picture of your expenses, including those that are irregular or seasonal.

#3. Overestimating Income

Image Credit: Shutterstock.

Just as underestimating expenses can harm your budget, so can overestimating your income. Always base your budget on your net income, not your gross income, and be cautious with variable income sources like bonuses or freelance work.

#4. Failing to Adjust Your Budget

Image Credit: Shutterstock / lunopark

Your financial situation can change, and your budget should reflect these changes. Regularly review your budget to accommodate changes in income, expenses, or financial goals.

#5. Ignoring Small Expenses

Image Credit: Shutterstock / Sunflowerey

Small, frequent expenses, like daily coffee runs, can add up quickly. Track these minor expenses as they’re often the easiest to reduce or eliminate if you need to.

#6. Not Saving for Emergencies

Image Credit: Shutterstock.

Failing to allocate funds for emergencies can derail your budget in times of crisis. Start to build an emergency fund covering at least three to six months of living expenses.

#7. Neglecting Retirement Savings

Image Credit: Shutterstock.

Not including retirement savings in your budget can jeopardize your financial future. Start making contributions to a retirement fund as early as possible, even if it’s a small amount.

#8. Impulse Purchases

Image Credit: Shutterstock / LinaGainanova

Impulse buying can quickly blow your budget. Try to differentiate between wants and needs, and give yourself a cooling-off period before making non-essential purchases. For example, for anything other than absolute essentials, I have a self-imposed 24-hour cooling-off period where I take the time to review if I really need to make that purchase.

#9. No Allocation for Entertainment

Image Credit: Shutterstock.

Completely cutting out entertainment and leisure can make your budget unrealistic and hard to stick to. Allow yourself some discretionary spending for enjoyment. Yes,

#10. Using Credit Cards Unwisely

Image Credit: Shutterstock.

Relying too heavily on credit cards without the ability to pay them off each month can lead to high-interest debt, undermining your budgeting efforts.

#11. Not Reviewing Regular Subscriptions

Image Credit: Shutterstock.

Regular subscriptions, even small ones, can add up. Regularly review your subscriptions and memberships, canceling those you no longer use or need.

#12. Overlooking Insurance Costs

Image Credit: Shutterstock.

Not accounting for insurance premiums in your budget can lead to financial strain. Ensure you include all insurance costs and review them annually for potential savings.

#13. Disregarding High-Interest Debt

Image Credit: Shutterstock.

High-interest debt, like credit card debt, eats into your budget. Prioritize paying off high-interest debts to reduce interest payments and free up more money for savings or other expenses.

#14. Lack of Financial Goals

Image Credit: Shutterstock.

Without clear financial goals, staying motivated and making effective budgeting decisions is challenging. Set short-term and long-term financial goals to guide your budgeting process.

#15. Not Comparing Prices

Image Credit: Shutterstock.

Failing to compare prices when shopping can result in overspending. Take time to research and compare prices, especially for significant purchases or regular expenses like groceries.

#16. Inconsistent Tracking of Expenses

Image Credit: Shutterstock.

Inconsistent tracking of expenses can lead to an inaccurate budget. Use a budgeting app or a spreadsheet to consistently monitor your spending.

#17. Not Planning for Taxes

Image Credit: Shutterstock.

Failing to plan for taxes can result in unexpected liabilities. If you have variable income, set aside a portion for taxes to avoid surprises at tax time.

#18. Ignoring Debt Repayment

Image Credit: Shutterstock.

Not including debt repayment in your budget can prolong your debt and increase interest costs. Develop a strategy for debt repayment and include it in your monthly budget.

#19. Emotional Spending

Image Credit: Shutterstock / Southtownboy Studio

Emotional spending can derail your budget. Recognize triggers that lead to emotional spending and develop strategies to cope without resorting to retail therapy.

#20. Not Shopping with a List

Image Credit: Shutterstock.

Shopping without a list, especially for groceries, can lead to unnecessary purchases. Always shop with a list to avoid buying items you don’t need.

#21. Forgetting Annual or Semi-Annual Expenses

Image Credit: Shutterstock.

Forgetting to budget for annual or semi-annual expenses like property taxes or car maintenance can cause financial stress. Divide these costs by 12 to include them in your monthly budget.

#22. Lack of Flexibility

Image Credit: Shutterstock.

A budget that’s too rigid is difficult to adhere to. Allow some flexibility to accommodate unexpected expenses or changes in income. Recognize that you’ll probably slip up and overspend at times because that’s human nature. Don’t beat yourself up. Acknowledge the overage, make room for it in your flexible budget, and move on.

#23. Not Having a Contingency Plan

Image Credit: Shutterstock.

Life is unpredictable, and not having a contingency plan in your budget for unexpected life changes is risky. Regularly review your budget to adapt to lifes changes.

#24. Peer Pressure Spending

Image Credit: Shutterstock.

Spending to keep up with friends or family can quickly lead to financial strain. Stick to your budget regardless of peer pressure and find affordable ways to socialize.

#25. Not Seeking Financial Advice

Image Credit: Shutterstock.

Not seeking professional financial advice when needed can result in missed opportunities for savings or more efficient budgeting. You can always consult with a financial advisor for personalized advice.

The post Avoid These Budgeting Traps to Keep Your Financial Future Secure first appeared on Thrifty Guardian.

Featured Image Credit: Shutterstock / Pixel-Shot.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

by Thrifty Guardian | Your Money

Open up any real estate app, and you’ll quickly see that home prices have hit staggering highs. For many aspiring homeowners, the American dream feels increasingly out of reach in this ballooning market. But there’s a silver lining on the horizon.

Analysts are pointing to a potential shift in 2024, with forecasts indicating that home prices in 13 specific cities are expected to drop. This change could open up new opportunities for first-time buyers and those looking for more affordable housing options.

#1. Boulder, CO

Image Credit: Shutterstock.

According to figures from the National Association of Realtors (NAR), median home prices in Boulder have already fallen by 2% as of February 2023 (from the prior year). In fact, a mass exodus of homeowners from Colorado has sparked concerns that the housing market in the state (including Boulder) could “collapse.”

If you are hunting for deals, Boulder is one of several Colorado cities to watch.

#2. San Francisco, CA

Image Credit: Shutterstock.

As of September 2023, the average home value in San Francisco had fallen by more than 11% compared with the previous year. With San Francisco’s stock falling, you might purchase property at a (relative) discount and hope the city returns to its Full House heyday.

However, remember that people are leaving San Francisco for good reason. Even with a decline in prices, the City by the Bay remains among the most expensive you can find in America, and that is just the beginning of former residents’ complaints.

#3. Boise, ID

Image Credit: Charles Knowles/Shutterstock.

Idaho has seen a greater contraction in housing prices in 2023 than any other state. With natural beauty and spades, why not invest in a high-quality coat and make Boise your home in 2024? If prices continue falling at a rate near their current pace, you will be able to get a steal.

#4. Seattle, WA

Image Credit: dibrova/Shutterstock.

Home prices in certain areas of Seattle have dropped by as much as 17% in 2023. The nationwide rise in interest rates, as well as concerns about Seattle’s safety and jobs market, are undoubtedly contributing to the decline.

While Seattle has long been a costlier-than-average city, home values are relative. If you’ve always wanted to live in Seattle and can stomach the less-than-favorable changes that have taken place in recent years, 2024 might be the year to realize your Pacific Northwestern Dream.

#5. Las Vegas, Nevada

Image Credit: Shutterstock.

Looking for a home within walking distance of world-renowned blackjack tables and sportsbooks? Do you have impeccable financial discipline and a wish to live in one of America’s most iconic cities?

Check out Las Vegas, which has seen a decline in median home sale prices of 3.6% between August 2022 and August 2023. While homes are still more expensive in Vegas than the national average, there are worse cities for homebuyers to take a gamble on their dream home.

#6. New Orleans, LA

Image Credit: Shutterstock.

The Crescent City remains one of the most unique, fun-loving, waistline-expanding, hangover-creating cities in the United States. Yet, even with all its charm, New Orleans’ chronic issues (potholed streets, rampant crime, unreliable police presence) are as bad as they’ve ever been.

Yet, if you can look past the city’s problems, home prices continue to decline at an accelerating pace. If you sense the market bottoming out in 2024, jump on a home like a pair of beads on the ground at Mardi Gras.

#7. Austin, TX

Image Credit: Sean Pavone/Shutterstock.

A city that may have seen greater post-pandemic price swelling than any other, Austin’s housing market is finally showing signs of coming down to earth. Though the cost of a home in Austin is still exorbitant, you might find a palatable investment in 2024. If a 2% decline in median home prices continues, you might be able to buy a home without selling your kidneys to afford the down payment.

#8. Phoenix, AZ

image Credit: Shutterstock.

Transplants from California made Phoenix one of the fastest-gaining home markets post-2020. However, the boiling-hot market seems to have cooled a bit. A 1.2% drop in median home values is noteworthy and could spell a good deal for those purchasing their desert dream house in 2024.

Word to the wise before you do buy in Phoenix. With the tenuous state of world affairs, budget for a generator in case the electric grid goes down in the middle of the Arizona summer.

#9. San Antonio, TX

Image Credit: Shutterstock / Sean Pavone

Those charmed by San Antonio’s riverwalk, history, and cuisine (Tex-Mex, anyone?) ask: Why shouldn’t I make San Antonio into San An-home-io?

2024 might be the time to answer that rhetorical question. San Antonio is one of several major Southern cities that have seen home value drops in 2023.

#10. Oakland, CA

Image Credit: Basil D Soufi, Own Work – CC BY-SA 3.0/Wiki Commons.

If you have any doubt that the California exodus is real, look at home prices. These figures reflect supply and demand. Oakland, a city once marked by growth and gentrification, saw a decline in home prices of more than 12% in 2023.

#11. Myrtle Beach, South Carolina

Image Credit: Shutterstock.

This Southern vacation town on South Carolina’s Atlantic coast has no shortage of entertainment, golf courses, and modern amenities. If you can brave the hustle and bustle of Myrtle Beach, a decline in median home values of more than 7% should be music to your ears.

Let the prices continue to fall, and find yourself a steal of a deal in 2024.

#12. San Diego, CA

Image Credit: Oxana Militsina / Shutterstock.

San Diego is one of the most desirable cities in the United States. San Diego also happens to be one of the cities Moody’s has tabbed as likely to see considerable price decreases in 2024. To quote Ron Burgundy, “Discovered by the Germans in 1904, they named it San Diego, which is, of course, German for ‘forever home at a rock-bottom price.'”

#13. Sarasota, FL

Image Credit: Shutterstock.

You’re going to end up in Florida eventually, so why not move in your 40s rather than your 80s? Homes near Sarasota’s idyllic beaches and Gulf views have dropped in cost by nearly 5% in 2023. Make 2024 your year to become a Sarasotan sooner rather than later.

The post 13 Places to Find Cheaper Homes in 2024 first appeared on Thrifty Guardian.

Featured Image Credit: Shutterstock / Andy Dean Photography.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

by Thrifty Guardian | Your Money

If you’re on the hunt for an extraordinary journey that breaks the mold of typical vacations, you’re not alone. In a recent online discussion, seasoned world travelers opened up about their most unforgettable adventures. These aren’t your average tourist destinations; they’re once-in-a-lifetime experiences that promise to ignite your wanderlust and inspire your next great expedition.

#1. Going on a Safari

Image Credit: Shutterstock.

Nothing comes close to the experience of heading into the Savannah in Kenya, Zimbabwe, or South Africa to experience your first safari.

If you don’t live in an area of Africa with ample wildlife, you’ll have to travel to enjoy a safari.

#2. Seeing a Solar Eclipse

Image Credit: Shutterstock.

Sometimes, you get lucky and won’t have to travel far for a solar eclipse. But you can make a long vacation out of it.

As one person shares, traveling to watch a solar eclipse is worth it. They added that they’re thinking of going to Mexico to make the viewing experience for the next one more fun.

#3. Going Snorkeling

Image Credit: Shutterstock.

I love swimming in the ocean, but not where I live in the Northeast. The water is freezing cold, plus there’s not much to look at.

But that’s completely different in many tropical areas where tourists flock to snorkel in their waters. You’ll find colorful fish, local sea life, and, depending on your location, coral reefs.

#4. Seeing a Rocket Launch

Image Credit: Shutterstock.

Space nerds and people who like big, fast vehicles unite! It’s not every day that someone can watch a rocket launch, but if you ever get the opportunity on your travels, it’s a moment of a lifetime.

#5. Exploring in Bioluminescence

Image Credit: Shutterstock.

There’s something magical about taking an oceanside vacation and heading out to the sea at night to watch the bioluminescence light up the water.

One person shared they loved kayaking the bioluminescent bay in Puerto Rico. If going to Puerto Rico isn’t your jam, many locations have gorgeous bioluminescence to explore.

#6. Soaking in a Hot Spring

Image Credit: Shutterstock.

The earth’s natural hot tub, a hot spring, is the perfect place to relax after a stressful week at work. One commenter shared they’ll go anywhere for a hot spring, mainly because they don’t have any geothermal areas nearby.

#7. Traveling for Sports Events

Image Credit: Jacob Lund/Shutterstock.

Each sporting event is a once-in-a-lifetime experience, so if you have a favorite team or sport with a big tournament coming up in a city you’ve always wanted to visit, why not hit two birds with one stone?

#8. Journeying to Music Festivals

Image Credit: Shutterstock / bbernard

Have you dreamt of hitting up Coachella in California or New Orleans Jazz Fest? It may be time to book those tickets. Attending music festivals can be an unforgettable experience where fans come together to have a great time in a beautiful new city.

#9. Exploring National Parks

Image Credit: anthony heflin and Shutterstock.

While I love the local conservation lands in my small city, they can’t compare to the sights in national parks like Yellowstone and Yosemite. You can’t replicate the wonders of nature across the country in your backyard, so you’ll have to visit them to get the experience.

#10. Visiting Food-Famed Cities

Image Credit: Shutterstock / Linda Hughes Photography

The biggest reason I love to travel is for the food. Nothing compares to the fresh seafood feast I devoured on a boat transversing Vietnam’s famous Halong Bay. I will cherish that moment for the rest of my life!

While you can find lots of international food near you, nothing compares to local food in a new country.

#11. Meeting Friendly Locals

Image Credit: Shutterstock.

One of the most underrated parts of traveling is meeting new people, being absorbed into their culture, and hearing their stories- especially if you happen to be traveling abroad. Getting involved with locals is a great way to get the most out of your travels. Plus, locals often have excellent tips for dining and local attractions.

#12. Going Hiking

Image Credit: Shutterstock.

There’s a chance most people have some local hiking trails through woods and parks, but that pales in comparison to what can be achieved through traveling.

The post The Ultimate Travel Bucket List for Wanderlust Seekers first appeared on Thrifty Guardian.

Featured Image Credit: Shutterstock / Emily Hamley.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

by Thrifty Guardian | Your Money

I love to garden. It’s therapeutic, gets me out in the fresh air, and lets me reconnect with nature. But it can get expensive, too. And, while there are plenty of genuine ways to save money on gardening costs, there’s also some terrible advice and “hacks” out there that will ruin your garden and end up costing you more or wasting your money in the long run.

#1. Overcrowding Plants to Save on Buying More

Image Credit; Shutterstock

Planting too closely to save on buying more plants can lead to overcrowding, which stifles growth and increases disease susceptibility. Plants need adequate space for air circulation and access to nutrients. Overcrowded plants compete for these resources, leading to weaker, less productive gardens.

#2. Using Cheap, Low-Quality Soil

Image Credit: Shutterstock.

Opting for inexpensive, low-quality soil might seem cost-effective but can harm your plants. Poor soil lacks the necessary nutrients and proper drainage, leading to stunted growth and increased vulnerability to pests and diseases.

#3. Making Homemade Pesticides Without Research

Image Credit: Shutterstock.

While homemade pesticides can be cheaper, using them without proper research can be harmful. Some homemade solutions are too harsh, damaging plants or disrupting the garden’s ecological balance. It’s crucial to understand the ingredients and their effects on your specific plants.

#4. Overusing Fertilizer to Boost Growth

Overusing fertilizer, especially chemical ones, to boost growth can lead to nutrient imbalances in the soil and harm plant health. Excessive fertilizer can burn plant roots and disrupt the natural soil microbiome, leading to long-term soil degradation.

#5. Ignoring Professional Advice for DIY Methods

Image Credit: Shutterstock

While DIY methods can save money, ignoring professional advice can lead to costly mistakes. Professionals have the expertise to diagnose and treat garden problems effectively. Misdiagnosing a problem or using incorrect treatments can lead to further damage.

#6. Reusing Diseased Plant Containers

Image Credit: Shutterstock

Reusing containers without properly disinfecting them can introduce diseases to new plants. Containers that previously held diseased plants can harbor pathogens. It’s important to clean and disinfect containers before reuse to prevent the spread of disease.

#7. Choosing Only Inexpensive Plants

Image Credit: Shutterstock

Selecting plants solely based on cost can lead to a mismatch with your garden’s conditions. Inexpensive plants that aren’t suited to your soil type, sunlight, or climate will struggle to thrive, wasting money and effort.

#8. Neglecting Mulch to Cut Costs

Image Credit: Shutterstock

Skipping mulch to cut costs leads to higher water usage and increased weed problems. Mulch helps retain soil moisture, suppress weeds, and improve soil quality. Without it, gardens may require more maintenance and resources.

#9. Overwatering to Promote Growth

Image Credit: Shutterstock.

Overwatering, often done to promote growth, can drown plants’ roots and lead to root rot. Do your research so you understand each plant’s watering needs and provide just enough water to meet them.

#10. Planting Non-Native Species to Save Money

Image Credit: Shutterstock.

Planting non-native species because they’re cheaper can disrupt your garden’s ecosystem. Non-native plants may not be compatible with local wildlife or soil conditions, and they can become invasive, outcompeting native plants.

#11. Using Improper Pruning Techniques to Save Time

Image Credit: Shutterstock.

Improper pruning techniques damage plants. Incorrect cuts can lead to disease, pest infestations, and poor growth. Learning the right pruning techniques for each plant is crucial for their health and aesthetics.

#12. Saving Seeds from Diseased Plants

Image Credit: Shutterstock.

Saving seeds from diseased plants to avoid buying new ones can perpetuate problems. These seeds may carry pathogens, leading to a new generation of diseased plants. It’s safer to purchase healthy, disease-free seeds unless you know how to save seeds properly.

#13. Applying Leftover Chemicals Indiscriminately

Image Credit: Shutterstock.

Applying leftover chemicals, such as herbicides or pesticides, indiscriminately to save on waste can harm beneficial insects and plants. It’s important to follow application guidelines and only use chemicals if absolutely necessary.

#14. Ignoring Pest Infestations to Avoid Costs

Image Credit: Shutterstock.

Ignoring pest infestations to avoid the cost of control can lead to widespread damage. Early intervention is key in managing pests. Neglecting the problem can result in higher costs and more damage over time.

#15. DIY Landscaping Without Proper Planning

Image Credit: Shutterstock.

Undertaking DIY landscaping projects without proper planning and knowledge can lead to poor design and plant choices. You may end up with a yard that requires excessive maintenance, additional water usage, and might not thrive in the long term.

The post When You Dig a Little Too Deep for Gardening Savings first appeared on Thrifty Guardian.

Featured Image Credit: Shutterstock / Maria Sbytova.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.