by Thrifty Guardian | Your Money

The home design trends of the past have always been influenced by the generation that grew up in them. For boomers, certain styles and designs were considered the epitome of sophistication and elegance, and they often embraced these trends as part of their frugal living ethos.

We take a look at 40 of these forgotten family home trends that remain beloved by Boomers, offering a glimpse into how frugality and smart choices with money have shaped their lifestyles and wealth, even in matters of home decor.

#1. All Wood Furniture

Image Credit: Shutterstock / Art_Maric

Millennials can appreciate the durability of all-wood furniture, a staple in boomer homes, as it often outlasts cheaper alternatives.

#2. Monotone

Image Credit: Shutterstock / Hanna Tsymbaliuk

Embracing a monotone color scheme can be cost-effective for Millennials, as it allows for easier matching of furnishings and decor.

#3. Word Arts

Image Credit: Shutterstock / Africa Studio

Vintage word art adds a touch of nostalgia to homes and can be a budget-friendly way to personalize living spaces.

#4. Pastel Colors

Image Credit: Shutterstock / Africa Studio

Pastel colors can create a calming atmosphere without breaking the bank, making them a practical choice for Millennials.

#5. Vertical Blinds

Image Credit: Shutterstock / Danielle Armstrong

While vertical blinds may be considered old-fashioned, they offer light control and privacy at an affordable price.

#6. Window Valances

Image Credit: Shutterstock / Window Valances

Reviving window valances can be a money-saving alternative to costly curtains or blinds.

#7. Animal Print

Image Credit: Shutterstock / Mike Higginson

Incorporating animal prints sparingly can add a touch of style without the expense of a complete room makeover.

#8. Floral Prints

Image Credit: Shutterstock / kryzhov

Floral prints can still be trendy for Millennials, especially when integrated into accent pieces or throw pillows.

#9. Linoleum Flooring

Image Credit: Shutterstock / StockphotoVideo

Linoleum flooring can be an economical choice that’s easy to maintain, making it a practical option for budget-conscious homeowners.

#10. Nautical Motifs

Image Credit: Shutterstock / Ground Picture

Nautical motifs can evoke a sense of wanderlust and adventure in your decor without overspending.

#11. Fake Fruit

Image Credit: Shutterstock / THIANCHAI THONGSUK

Fake fruit decor is a charming and low-cost way to add color and texture to kitchen spaces.

#12. Faux Plants

Image Credit: Shutterstock / widna

Millennials can opt for faux plants to enjoy the greenery without the commitment and expense of real plants.

#13. Crystal Chandeliers

Image Credit: Shutterstock / Rostov Oleksandr

Vintage crystal chandeliers can lend an air of luxury to a room without the high-end price tag.

#14. Popcorn Ceilings

Image Credit: Shutterstock / MC Media

Instead of removing popcorn ceilings, Millennials can embrace them as a unique design element or paint them to freshen up the look.

#15. Vaulted Ceiling

Image Credit: Shutterstock / Artazum

Vaulted ceilings can make a room feel more spacious without the need for extra square footage.

#16. Carpeted Bathrooms

Image Credit: Shutterstock / sirtravelalot

Carpeted bathrooms may seem unusual to Millennials, but they offer comfort and warmth without the need for cold tiles.

#17. Open Shelving

Image Credit: Shutterstock / stock_studio

Open shelving can be an affordable way to display and organize kitchen items, creating a trendy and functional space.

#18. Stereo Racks

Image Credit: Shutterstock / Vizbara

Repurpose vintage stereo racks as unique storage solutions, combining style and practicality.

#19. Mass-Produced Furniture and Art

Image Credit: Shutterstock / New Africa

Millennial homeowners can find budget-friendly, mass-produced furniture and art pieces to fill their homes stylishly.

#20. Furniture Skirts

Image Credit: Shutterstock / GracePhotos

Furniture skirts can add a touch of elegance while hiding wear and tear on older furnishings.

#21. High Back Dining Chairs

Image Credit: Shutterstock / Jason Finn

High-back dining chairs can create an upscale dining atmosphere without a high-end price tag.

#22. Clear Furniture

Image Credit: Shutterstock / yampi

Transparent furniture pieces can make small spaces appear less crowded and are often more affordable than solid alternatives.

#23. Midcentury Modern

Image Credit: Shutterstock / Aspects and Angles

Embracing midcentury modern design can offer timeless style at a reasonable cost.

#24. Mirrored Closet Doors

Image Credit: Shutterstock / Procreators

Mirrored closet doors can make rooms feel larger and more open without the need for expensive renovations.

#25. Glass Block Showers

Image Credit: Shutterstock / mbHY!8e7y5NzXvx

Glass block showers provide privacy and natural light, making them an attractive and budget-friendly option.

#26. Ceramic Decorations

Image Credit: Shutterstock / Morrowind

Ceramic decorations can be an affordable way to add artistic touches to your home.

#27. China Display

Image Credit: Shutterstock / Ground Picture

Displaying fine china can infuse elegance into dining spaces while showcasing cherished heirlooms.

#28. Terrazzo Pattern

Image Credit: Shutterstock / jordaneil

Terrazzo patterns can be recreated with budget-friendly materials for a trendy and economical flooring option.

#29. Accent Walls

Image Credit: Shutterstock / Chamomile_Olya

Creating accent walls with affordable paint or wallpaper can transform a room’s look without a hefty price tag.

#30. Bulky Corner Tubs

Image Credit: Shutterstock / Jason Finn

Bulky corner tubs can provide relaxation without the need for a costly spa renovation.

#31. Sleigh Beds

Image Credit: Shutterstock / Mike Higginson

Sleigh beds can add a touch of romance and luxury to bedrooms without breaking the bank.

#32. Tile Countertops

Image Credit: Shutterstock / BUNDITINAY

Opting for tile countertops can be a cost-effective way to achieve a unique and stylish kitchen look.

#33. Tiffany Lamps

Image Credit: Shutterstock / milosljubicic

Vintage Tiffany lamps can illuminate your space with timeless charm while remaining budget-friendly.

#34. Lace Doilies

Image Credit: Shutterstock / Frances van der Merwe

Incorporate lace doilies for a touch of vintage elegance in your decor without spending a fortune.

#35. Wood Paneling

Image Credit: Shutterstock / Jodie Johnson

Wood paneling can be repurposed for a rustic or cozy ambiance without the cost of major renovations.

#36. Gold Hardware

Image Credit: Shutterstock / Hendrickson Photography

Gold hardware accents can bring a touch of opulence to your home without a hefty price tag.

#37. Worn Out Phrases

Image Credit: Shutterstock / flyesra

Decorate with worn out phrases that hold sentimental value or add character to your space.

#38. Carpeted Toilet Seat Cover

Image Credit: Shutterstock / ARENA Creative

Revive vintage carpeted toilet seat covers as quirky and nostalgic bathroom decor.

#39. Knitted Table Runners and Curtains

Image Credit: Shutterstock / MARYIA SAMALEVICH

Handmade knitted table runners and curtains can add warmth and character to your home.

#40. Farmhouse Style

Image Credit: Shutterstock / Vadim Ovchinnikov

Embrace farmhouse-style decor for a timeless and budget-friendly aesthetic in your living spaces.

These frugal design choices from the past can inspire cost-conscious Millennials to create stylish and economical homes.

The post Budget-Friendly Home Trends Boomers Love first appeared on Thrifty Guardian.

Featured Image Credit: Shutterstock / Pressmaster.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.

by Thrifty Guardian | Your Money

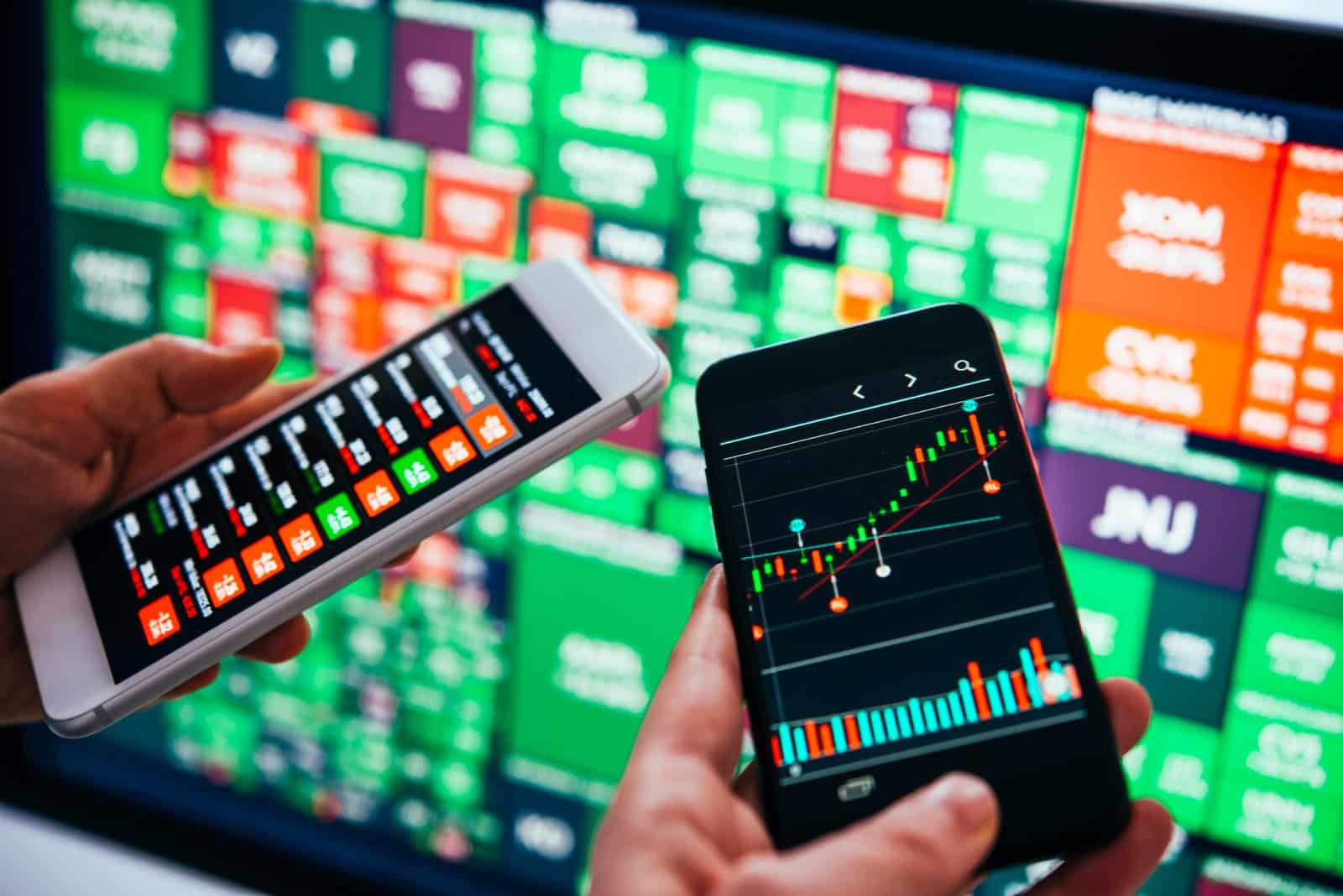

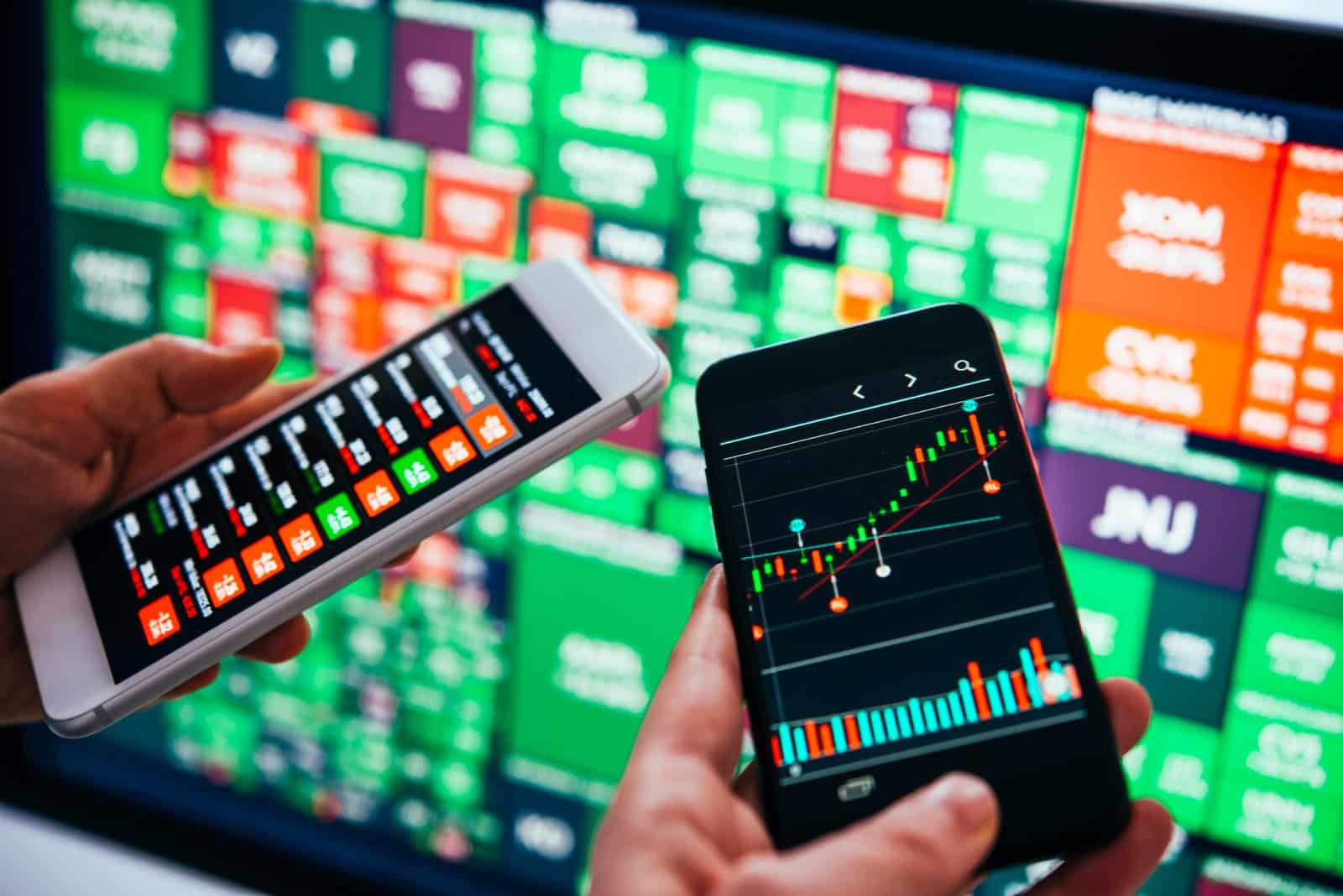

Technical analysis (TA) is a key tool in the investing world, yet it is often shrouded in misunderstandings and controversy. For new investors in particular it is critical to understand along with its inherent risks.

Understanding Technical Analysis

Image Credit: Shutterstock / Andrey_Popov

Technical analysis, or TA, is a method used by traders and investors to determine the best times to enter and exit trades. It involves analyzing stock quantitative price patterns and trends. TA is not about predicting the future with certainty; it’s about making educated guesses based on historical data.

The Misconceptions

Image Credit: Shutterstock / Viktoriia Hnatiuk

Often criticized as mere speculation or even fortune-telling, technical analysis faces much skepticism. This skepticism is partly due to the over-promotion of unreliable trading systems online. However, understanding its proper use and limitations is key to leveraging its benefits effectively.

A Tool, Not a Magic Wand

Image Credit: Shutterstock / Freedomz

TA is not a standalone strategy for guaranteed profits. It’s a supplementary tool that, when used correctly, can enhance trading decisions. It’s vital to remember that TA is just one aspect of a comprehensive trading strategy.

Indicators and Strategies

Image Credit: Shutterstock / SkazovD

Technical analysis encompasses various indicators and strategies, focusing on aspects like momentum, trend, and volatility. These indicators help in identifying potential bullish or bearish market conditions and assist traders in making more informed decisions.

The Role of Chart Studies

Image Credit: Shutterstock / Zodar

Apart from indicators, chart studies play a crucial role in TA. They involve identifying key price ranges, support, and resistance levels using tools like trend lines and Fibonacci patterns. These studies aid in understanding market dynamics more thoroughly.

Limitations of TA

Image Credit: Shutterstock / Lim Yong Hian

It’s important to acknowledge that TA cannot predict unforeseen market events or company announcements that can drastically affect stock prices. Over-reliance on technical analysis without considering other factors can lead to misguided trading decisions.

Risks for New Investors

Image Credit: Shutterstock / Nattawit Khomsanit

For newcomers to the investment world, understanding the risks associated with TA is crucial. Misinterpreting data or solely relying on TA without a broader market understanding can lead to significant financial losses.

Essential Risk Management

Image Credit: Shutterstock / fizkes

Risk management is a fundamental aspect of using technical analysis effectively. Investors should be aware of their investment capacity, set clear stop-loss limits, and establish realistic profit targets to mitigate potential losses.

The Pitfall of Overconfidence

Image Credit: Shutterstock / Ground Picture

New investors often fall into the trap of overconfidence when using TA. Misusing indicators or ignoring risk management can result in severe financial setbacks. A balanced approach is key.

Integration with Investment Strategies

Image Credit: Shutterstock / Hryshchyshen Serhii

Integrating TA with overall investment strategies enhances its effectiveness. It should not be the sole basis for trading decisions but rather a component of a diversified investment approach.

Understanding Market Signals

Image Credit: Shutterstock / GaudiLab

Learning to interpret market signals through technical analysis is a skill that requires time and practice. New investors should approach TA with a mindset of continuous learning and adaptation.

Avoiding Common Mistakes

Image Credit: Shutterstock / SFIO CRACHO

Common mistakes in using TA include over-relying on indicators, not back-testing strategies, and inadequate understanding of market context. Avoiding these pitfalls can lead to more successful investment outcomes.

The Reality of Market Fluctuations

Image Credit: Shutterstock / ESB Professional

The stock market is inherently unpredictable. TA can provide insights, but it cannot guarantee outcomes. Investors should be prepared for market fluctuations and adjust their strategies accordingly.

Building a Solid Foundation

Image Credit: Shutterstock / Ground Picture

New investors should focus on building a solid foundation in market understanding and investment principles. Technical analysis should complement this foundation, not replace it.

Long-term Perspective

Image Credit: Shutterstock / fornStudio

While TA can be useful for short-term trading, maintaining a long-term perspective is crucial. Understanding market trends over time can lead to more sustainable investment decisions.

Be Mindful of Risks

Image Credit: Shutterstock / Viktoriia Hnatiuk

Technical analysis is a valuable tool, but it’s not infallible. For new investors, the key is to use TA as part of a balanced, well-informed investment strategy, always keeping in mind the potential risks and the importance of ongoing learning and adaptation in the ever-changing world of finance.

The post Investing Smart: Strengths and Weaknesses of Technical Analysis first appeared on Thrifty Guardian.

Featured Image Credit: Shutterstock / Viktoriia Hnatiuk.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

by Thrifty Guardian | Your Money

In 2024, savers face a whole host of challenges and opportunities. With anticipated shifts in interest rates, understanding how to maximize returns on savings is crucial.

Understanding the Forecast

Image Credit: Shutterstock / Thapana_Studio

Following a period of high rates, experts are predict a decline in interest rates for 2024. This shift impacts savings accounts, Certificate of Deposit accounts (CDs), and other interest-bearing accounts.

Staying informed and proactive is key to maximizing returns in this dynamic environment.

Lock in High CD Rates Now

Image Credit: Shutterstock / Vitalii Vodolazskyi

Securing a high CD rate before potential declines can lock in better returns. CDs offer stable interest rates over their term, making them a solid choice for funds not immediately required. The provide a fixed return on investment for the duration of the CD.

Protect Against Decreases

Image Credit: Shutterstock / Kenneth William Caleno

Similar to locking in a low mortgage rate, securing a high CD rate can protect from future rate decreases. This strategy guarantees continued benefits from current high rates, even if the overall rate environment declines.

Exploring High-Yield Savings

Image Credit: Shutterstock / FON’s Fasai

High-yield savings accounts offer more flexibility than CDs. While their rates might fluctuate, choosing a financial institution with a history of competitive rates can optimize earnings. It is necessary to balance liquidity needs and return goals when choosing between CDs and high-yield savings.

The Role of Money Market Accounts

Image Credit: Shutterstock / Wanan Wanan

Money market accounts blend the features of savings and checking accounts, often offering higher interest rates with certain restrictions. They are a viable option for savers seeking higher returns without locking funds away, as in CDs.

Investing in Fixed-Income Assets

Image Credit: Shutterstock / Inna Kot

Fixed-income investments like Treasury bills or bonds provide a more secure investment option with steady interest returns. While these might offer lower yields than other assets, their stability can be appealing in a volatile rate environment.

Assessing Annuities for Higher Yields

Image Credit: Shutterstock / PeopleImages.com – Yuri A

Annuities, particularly multi-year guaranteed annuities, can offer high yields with the added benefit of tax-deferred interest. However, they often come with fees and penalties, making them a complex choice requiring careful consideration.

Navigating Rate Fluctuations

Image Credit: Shutterstock / Pixelated 275

Regardless of rate trends, opportunities to earn significant interest income exist. Being aware of the products available and adjusting strategies as rates change will help maximize returns.

Locking in Rates for Long-Term Gains

Image Credit: Shutterstock / Svetlana Lukienk

If rates fall, locking in high rates now can safeguard returns for years. This proactive approach ensures that savers can benefit from the current high-rate environment, despite future decreases.

Potential for Rate Increases

Image Credit: Shutterstock / faithie

Conversely, if rates rise, having investments nearing maturity makes it possible to take advantage of higher rates quickly.

Early withdrawal penalties might apply for longer-term investments, but they might be offset by the benefits of reinvesting at higher rates.

Diversifying Savings Strategies

Image Credit: Shutterstock / suksom

Diversifying across different account types and investment vehicles can help balance risk and reward.

Combining CDs, high-yield savings, and fixed-income assets can create a robust savings portfolio capable of adapting to rate changes.

Working with Financial Advisors

Image Credit: Shutterstock / ESB Professional

Consulting with financial planners can provide tailored advice to align one’s savings strategy your long-term financial goals.

They can help navigate the complexities of the interest rate environment to optimize savings for the long term.

Staying Flexible

Image Credit: Shutterstock / Lek_charoen

In a changing interest rate environment, regularly reviewing savings and investment strategies ensures savers are always positioned to maximize returns.

The Importance of Financial Education

Image Credit: Shutterstock / fizkes

Educating yourself about different savings and investment options empowers savers to make knowledgeable decisions.

It is important to utilize resources and tools available to stay updated on the latest financial trends and strategies.

Planning for the Future

Image Credit: Shutterstock / Prostock-studio

Looking ahead, it is important to consider how today’s decisions will impact long-term financial health.

Whether planning for retirement, major purchases, or financial emergencies, a well-thought-out savings strategy is essential.

Stay Informed

Image Credit: Shutterstock / Zivica Kerkez

By understanding the interest rate environment and employing smart strategies, savers can effectively navigate changes and make the most of their investment capital.

It is crucial to stay informed, diversify a savings approach, and seek professional advice to make the most of one’s financial future.

The post Stretching Your Dollars in 2024: Essential Saving Tips first appeared on Thrifty Guardian.

Featured Image Credit: Shutterstock / Krakenimages.com.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

by Thrifty Guardian | Your Money

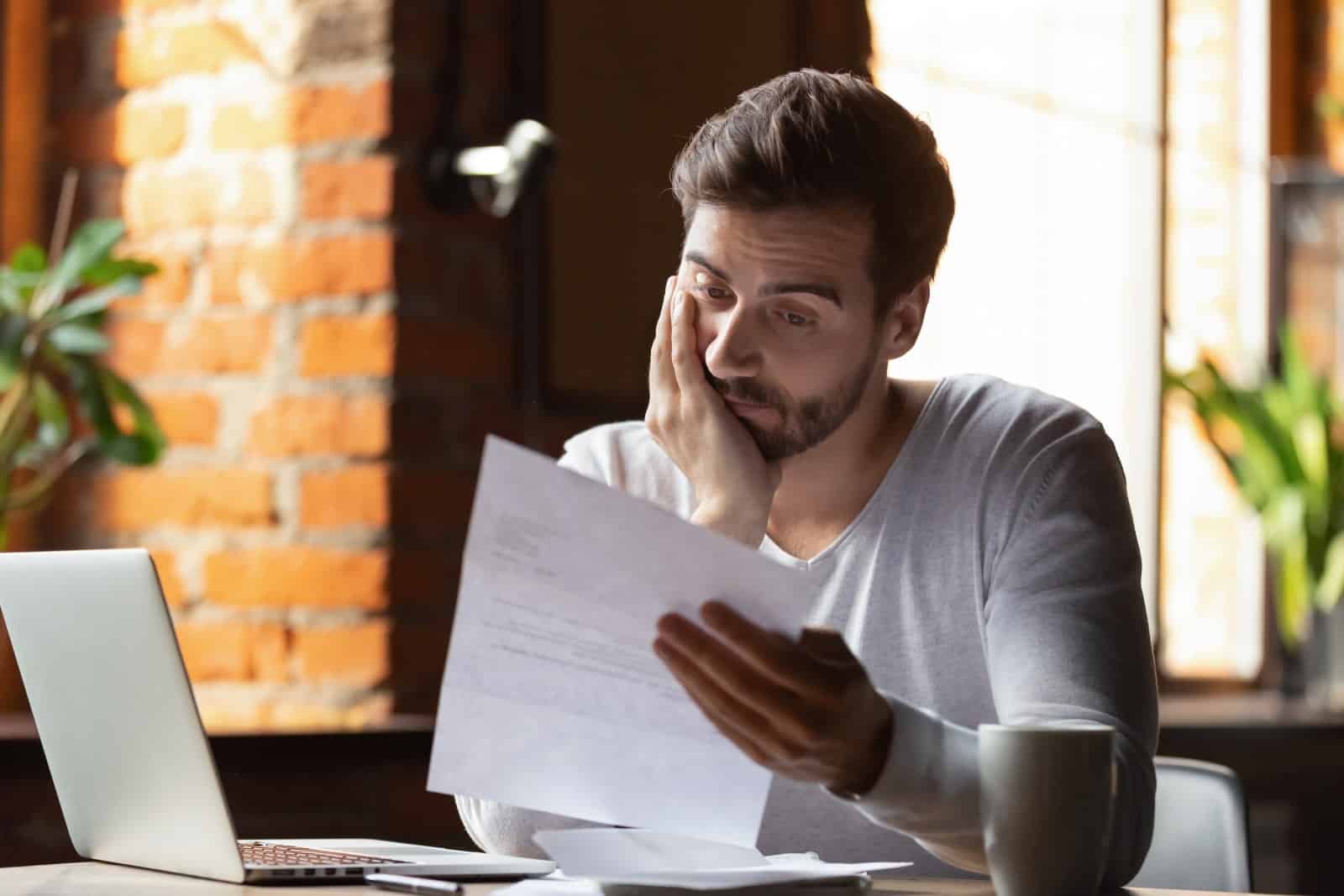

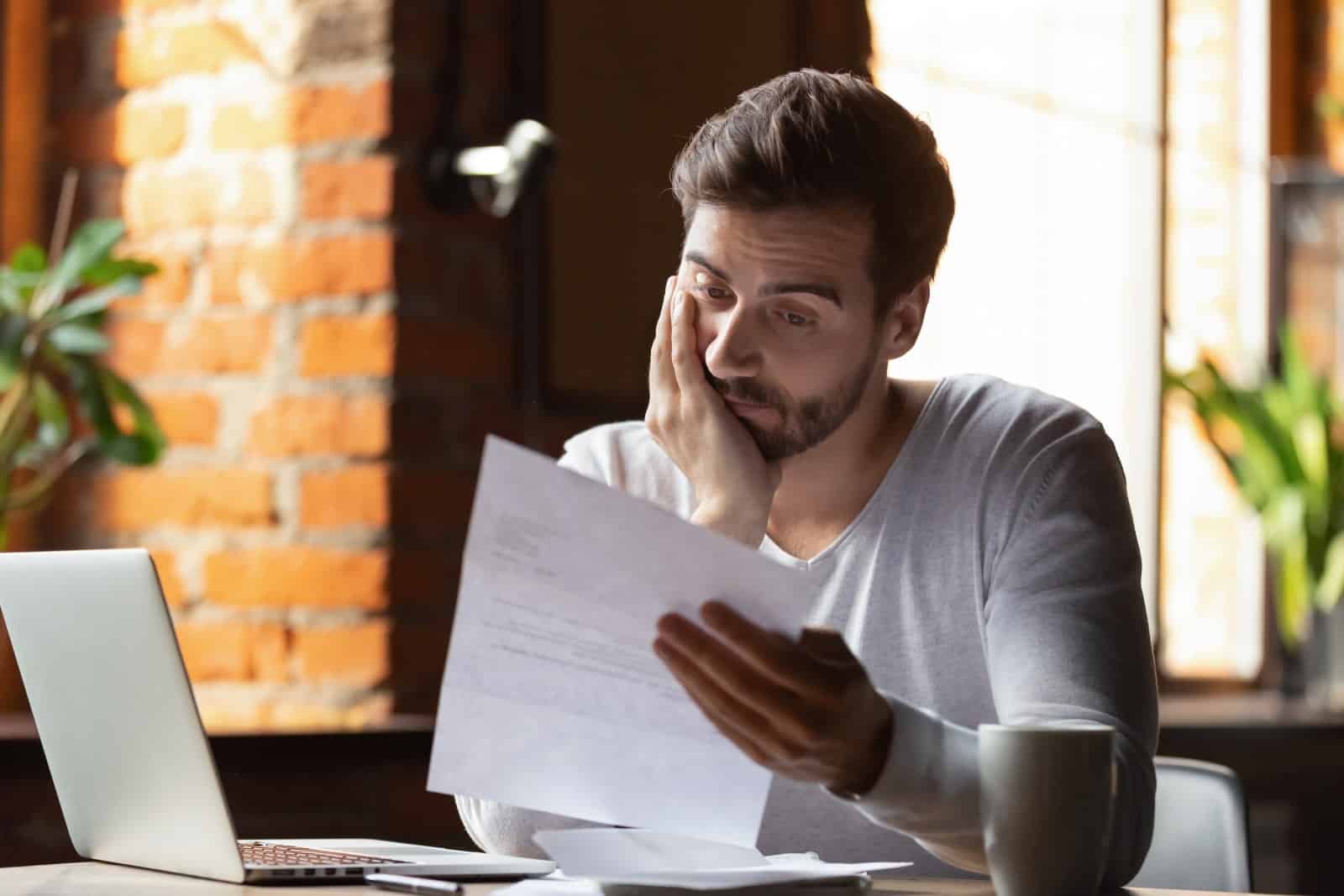

The housing crisis in the United States has left many people in vulnerable situations, and millennials are feeling the brunt of its impact. There are options for homeownership even in a contentious market.

The State of the Market

Image Credit: Shutterstock / Simone Hogan

It’s no secret that the housing market is struggling to recover after mortgage rates soared in 2023, pricing many would-be buyers out of the option to own their own home.

A Change to the Status Quo

Image Credit: Shutterstock / Svitlana Hulko

Prior to the rate surges, millennials were starting to represent a greater proportion of homeowners in the United States. As of 2022, over half of American millennials owned their homes.

Factors Affecting Homeownership

Image Credit: Shutterstock / Pormezz

Now that there is a housing shortage and interest rates are still hovering around 6%, the remaining millennials are left to wonder whether their homeownership hopes are futile.

Housing Market Whiplash

Image Credit: Shutterstock / Deemerwha studio

Millennials lived through the 2008 recession, followed by the historically low-interest rates of the 2010s, then interest rates over 8% post-pandemic. This understandably gave many older millennials a sense of housing market whiplash as they tried to figure out when to buy.

Predicted Balance

Image Credit: Shutterstock / Andrey_Popov

“I think we are in for a period of relatively flat housing price performance around the country as high mortgage rates put downward pressure on prices, while significant demand from household formation and an inventory shortage place upward pressure,” said housing economist Ken H. Johnson.

He expects that the elements at play will bring balance to the industry.

Looking Toward Homeownership

Image Credit: Shutterstock / michaeljung

As the market moves into 2024, millennials who are still renting look toward the seemingly stabilizing market in hopes of purchasing a home this year.

Navigating that landscape is difficult for folks in their late 20s to early 40s who hope to break out of the rental cycle, but there are ways to make the home-buying process easier and more attainable.

Down Payment Assistance Programs

Image Credit: Shutterstock / Tada Images

Down payment assistance programs (DPAs) are available in almost every state. Some employers, government agencies, and other organizations have programs that give grants to first-time homebuyers to put towards buying a home.

A Helping Hand for Millennials

Image Credit: Shutterstock / BongkarnGraphi

The rules and guidelines for each of these grants vary but typically have income limits and rules about when you can sell or refinance the property.

These programs are excellent resources for millennials who are ready to buy but don’t have the funds saved for a down payment.

Gifts from Relatives or Friends

Featured Image Credit: Shutterstock / Kaikoro

Mortgage guidelines allow for relatives (and even friends, under certain circumstances) to provide down payment funds in the form of a gift to a homebuyer.

This typically involves both parties signing a gift letter which states that the money is not a loan and does not have to be paid back. It can be paid to the buyer directly or sent to the closing agent to be applied to the purchase.

Buying In More Affordable Locations

Image Credit: Shutterstock / silverkblackstock

Many millennials have opted to relocate to areas of the country with lower costs of living. Homes are often cheaper in middle America and the south, making homeownership more attainable.

Remote Working Means Flexibility

Image Credit: Shutterstock / Vadym Pastukh

Since so many jobs can be done remotely in a post-COVID world, it matters less and less where you live. Some people are able to get remote jobs in a large city and live in rural areas where costs are lower.

Knowing What Options Are Available

Image Credit: Shutterstock / Vitalii Vodolazskyi

For millennials who are veterans or current military members, the VA (Veterans Affairs) loan offers a mortgage at 100% financing, eliminating the need for a down payment.

Homebuyer Loans

Image Credit: Shutterstock / SaiArLawKa2

Homebuyers who make less than their area’s median income and are buying in rural areas may qualify for USDA loans, which also don’t require a down payment. FHA loans start at as much as 96.5% financing, requiring only 3.5% of the purchase price as a down payment on a new home.

Those loans are available for properties that qualify and can often cater to buyers with lower credit scores.

Mortgage Options

Image Credit: Shutterstock / Priceless-Photos

Conventional mortgages require down payments, but there are options to obtain private mortgage insurance or obtain certain types of first-time homebuyer loans that make those mortgages easier to obtain.

Programs through Fannie Mae and Freddie Mac can lower a down payment from the standard 20% to something that is easier to handle.

Flexible Down Payments

Image Credit: Shutterstock / Vitalii Vodolazskyi

Statistically, millennials opt for mortgages that allow them to put down 10% of the home’s price, financing the rest.

Private mortgage insurance rates vary, but allow for more flexibility in the down payment, which is an advantage for millennials whose adult years have been plagued by economic difficulties nationwide.

A Changing Landscape

Image Credit: Shutterstock / Andrii Yalanskyi

2024 homebuyers can expect to see slightly lower rates, but experts don’t think a crash is coming. Yun says that prices may stabilize, but inventory is still low and the expectation is that the overall market will correct itself soon.

“We will not have a repeat of the 2008-2012 housing market crash,” said Lawrence Yun, Chief Economist from the National Association of Realtors. “There are no risky subprime mortgages that could implode, nor the combination of a massive oversupply and overproduction of homes.”

Take Heart

Image Credit: Shutterstock / Songsak C

Millennials can take heart – their homeownership dreams have not been crushed, and there are options for buying if they know where to look.

The post Millennial Home-Buying in 2024: Smart Strategies for Success first appeared on Thrifty Guardian.

Featured Image Credit: Shutterstock / 4 PM production.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

by Thrifty Guardian | Your Money

The ever-fluctuating housing market has been the topic of speculation for decades. Financial experts, economists, and even regular home buyers often wonder about the stability of this sector. While it’s impossible to predict the future with certainty, there are certain signs that can provide clues. Here, we’ll explore key indicators – some suggesting a crash and others hinting at continued stability.

#1. Rising Interest Rates → Crash

Image Credit: Shutterstock / Doubletree Studio

If central banks increase interest rates, it can make mortgages more expensive, leading to decreased demand for houses and potentially a drop in prices.

#2. Overvaluation → Crash

Image Credit: Shutterstock / Tinnakorn jorruang

When house prices surpass what’s sustainable by income levels, it might indicate a looming bubble.

#3. High Levels of Debt → Crash

Image Credit: Shutterstock / Andrii Yalanskyi

Consumers overleveraged with debt, especially mortgages, might default with a slight economic downturn.

#4. Speculative Buying → Crash

Image Credit: Shutterstock / epiximages

An abundance of people buying homes to flip for a quick profit is a sign of an overheated market.

#5. Deterioration in Home Affordability → Crash

Image Credit: Shutterstock / Andrii Yalanskyi

If the majority can’t afford homes based on their income, demand might decrease.

#6. Influx of “Easy” Money → Crash

Image Credit: Shutterstock / Burdun Iliya

Too much capital chasing too few homes can inflate prices beyond sustainable levels.

#7. Declining Construction → Crash

Image Credit: Shutterstock / Virrage Images

A consistent fall in new home construction might indicate that builders are anticipating lower demand.

#8. Changes in Tax Policy → Crash

Image Credit: Shutterstock / fizkes

Governments removing or reducing property tax deductions or other housing benefits can impact buyer enthusiasm.

#9. Steady Economic Growth → Boom

Image Credit: Shutterstock / Andrey_Popov

A thriving overall economy with abundant jobs can lead people to buy homes, supporting housing prices.

#10. Limited Housing Supply → Boom

Image Credit: Shutterstock / BearFotos

Low housing inventory compared to demand can keep prices stable or rising.

#11. Strict Lending Standards → Boom

Image Credit: Shutterstock / Brian A Jackson

Tightened post-2008 lending standards make it harder for high-risk buyers to get mortgages.

#12. Strong Rental Market → Boom

Image Credit: Shutterstock / New Africa

A robust demand for rentals offers homeowners a safety net, as they can rent out.

#13. Population Growth → Boom

Image Credit: Shutterstock / Felipe Teixeira

A continuous increase, especially in urban areas, can keep the demand for housing high.

#14. Government Support → Boom

Image Credit: Shutterstock / Vitalii Vodolazskyi

Programs that back homeownership, like tax incentives, can sustain demand.

#15. Stable Global Economy

Image Credit: Shutterstock / Thx4Stock

Foreign investments, especially in premier cities, can bolster the housing market.

In the complex dance of economic factors, the housing market’s fate lies in a delicate balance. While we’ve outlined some signals here, it’s essential to recognize their interplay and the broader geopolitical scenario. Investing in real estate requires careful consideration, due diligence, and sometimes, a bit of luck. Stay informed, stay alert, and make decisions tailored to your individual situation.

The post Beware of These Housing Market Warning Signs first appeared on Thrifty Guardian.

Featured Image Credit: Shutterstock / BaLL LunLa.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.

by Thrifty Guardian | Your Money

According to news reports, the U.S. job market is robust, and employers are desperate for workers. Despite these claims, many people, especially those over 60, struggle to find employment. Being a mature jobseeker doesn’t mean being automatically excluded from the workforce. There are several things experienced workers can do to land their ideal position. People offered tips on landing jobs for workers of a certain age, and their advice is worth noting.

#1. Prioritize Your Job Search

Image Credit: Shutterstock.

Looking for a new career isn’t easy, so your job search should be considered a full-time occupation. Each day, prepare yourself as if you already had a job – get dressed, fix your hair, have breakfast, etc. – then start hitting the job boards. It may take a few months or longer before landing your first interview, but think of this time as an investment in yourself, and you can’t put a price tag on that.

#2. Become a Consultant

Image Credit: Shutterstock.

Becoming a consultant is one of the best ways to leverage your knowledge and experience. Create a name for your consulting company and register as the only member of a limited liability company (LLC) with the Internal Revenue Service (IRS). You can seek contracts with private companies, non-profit organizations, or government agencies. Consulting work can also lead to full-time employment.

#3. Look for Government Jobs

Image Credit: Shutterstock.

Jobseekers with years of professional experience shouldn’t limit their search to the private sector. Open jobs are abundant in all levels of government, including city, county, state, and federal entities. Workers of all backgrounds can find an occupation that suits them. Some of the many upsides to a government job are stability, paid holidays, and generous pensions.

#4. Apply for a Postal Job

Image Credit: Shutterstock.

One type of government job that is in high demand and provides job security, excellent wages, and benefits is working for the U.S. Postal Service. If the thought of being a mail carrier doesn’t appeal to you, don’t worry. There are available positions that don’t involve being out in the elements. You can find work in sorting, handling, sales, service, driving, and mechanical.

#5. Network, Network, Network

Image Credit: Shutterstock.

One of the best tools out there for finding another career is to network. Contact people you know professionally or personally to ask if they know of any current or upcoming job openings with their companies. LinkedIn is an ideal platform for connecting with other professionals and groups. You’ll only know what opportunity is out there if you ask first!

#6. Work on a Freelance Basis

Image Credit: Shutterstock.

Freelancing is a great income source, especially while seeking a full-time job. There are websites with postings of available freelance jobs and platforms for freelance workers to offer their services, like Upwork and Fiverr. When you work as a freelancer, you can set your schedule and work as little or as much as you want. If flexibility is important, freelancing may be the way to go.

#7. Sharpen Your Skills

Image Credit: Shutterstock.

No matter your knowledge of a particular subject, there’s always room to learn more. Consider taking a free or low-cost online training course to develop a new skill or enhance your existing skills. Contact your local job center to see if you qualify for free training, especially if you’re a displaced worker. The additional education is a great addition to a resume.

#8. Start Part-time

Image Credit: Shutterstock.

If there’s a company or organization you’d love to work for, consider working as a part-time employee. You won’t receive the full-time pay and benefits, but at least it gets your foot in the door. Use that part-time employment as a chance to show the company what you bring to the table. That can become the path to a full-time career if that’s what you’re looking for.

#9. Non-profit Work

Image Credit: Shutterstock.

The non-profit sector isn’t traditionally known for having the highest salaries. Still, the work can be personally fulfilling and professionally rewarding. In addition, non-profit organizations generally have excellent benefits and more flexible employment terms like remote or hybrid work. If you’re willing to take a salary cut in exchange for career satisfaction, a career with a non-profit organization may be in the cards for you.

#10. Refresh Your Resume

Image Credit: Shutterstock.

If you can’t remember the last time you updated your resume, it’s time to spruce it up. For starters, only include your relevant employment history from the previous ten years. Highlight your achievements with each employer, and don’t be afraid to sing your praises. You’re selling yourself to prospective employers to land a new career. It’s not the time to be shy.

#11. Get Career Counseling

Image Credit: Shutterstock.

If you’re having difficulty finding a new job or don’t know where to start, seek career counseling and coaching services either in your area or online. Some of these programs are for mature job seekers. They can help update your resume, create or update your LinkedIn page, and help you prepare for job interviews. They can also assist you in creating a portfolio of your work if needed.

#12. Expand Your Horizons

Image Credit: Shutterstock.

If your current or previous occupation is in one field, that doesn’t mean you’re limited to careers in that realm. Your experience and skills may be transferable to other career areas. Do your research, talk to others in the industries you’re interested in, see how your skills match potential careers, and apply. There’s no harm in taking a chance on something new.

#13. Be Tech Savvy

Image Credit: Shutterstock.

Being a seasoned worker doesn’t mean you’re clueless regarding technology. Even if tech isn’t your strong suit, you can still learn the basics and work up from there. Familiarize yourself with software programs like Microsoft 365 and Adobe Creative Cloud. There are free online tutorials that teach you how to use them. You don’t have to be an expert-level user, but a basic knowledge of how they function can only help.

#14. Include Cover Letters

Image Credit: Shutterstock.

Your resume may be complete with your skills and achievements, but cover letters are a wonderful opportunity to explain to a prospective employer why you are a good fit with their company and why they should hire you. Cover letters are also useful for including details not in your resume and describing how your experience fits a specific role within an organization.

#15. Be Confident

Image Credit: Shutterstock.

Your extensive career experience is something to celebrate; you shouldn’t be afraid to let that light shine. You may not have the exact qualifications for the job you’re applying for, and that’s okay! If you go into the job searching and interviewing processes feeling confident in yourself and your abilities, that makes the best impression on hiring managers.

The post Strategies for Success Later in Your Career first appeared on Thrifty Guardian.

Featured Image Credit: Shutterstock / fizkes.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.