by Joe Lysikatos | Better You

In a potentially disastrous turn of events, up to 30 million of the most economically vulnerable Americans face expulsion from the Medicaid program due to flawed state reviews. Health consulting firm Avalere warns that these flawed evaluations, marked by a series of systemic issues, could have devastating consequences for the nation’s neediest citizens. Despite these troubling projections, advocates argue that the Biden administration has been criminally slow in its response to stem this impending crisis.

Medicaid Meltdown

Image Credit: Shutterstock / Davizro Photography

States across the country are currently undergoing a comprehensive reassessment of the 94 million individuals enrolled in Medicaid.

The Troubled Landscape of Medicaid Reviews

Image Credit: Shutterstock / fizkes

However, this massive undertaking has been marred by a multitude of problems, ranging from excruciatingly long phone wait times in Florida to perplexing government forms in Arkansas and wrongful exclusions of children in Texas.

Legal Aid Frustrations

Image Credit: Shutterstock / Davizro Photography

Trevor Hawkins, an attorney for Legal Aid of Arkansas, expressed frustration at the lack of responsiveness from the Centers for Medicare and Medicaid Services (CMS) after raising concerns about Arkansas’ flawed process.

Hawkins emphasized the failure of CMS to provide clear information about the ongoing situation, leaving advocates in the dark.

Critics Say Not Enough Done

Image Credit: Shutterstock / pathdoc

Despite the challenges, according to experts, the Biden administration has not taken sufficient action to rectify the mounting issues.

Trevor Hawkins remarked, “They ask questions but they don’t tell us what is going on. Those should be major red flags. If there was a situation where CMS was to step in, it would have been Arkansas.”

Policy Shift Fallout

Image Credit: Shutterstock / Perfect Wave

In response to the challenges posed by the pandemic, the federal government had implemented a policy preventing states from removing individuals from Medicaid during this period.

However, with the conclusion of this policy, states are now obligated to review the eligibility of every enrollee over the next year.

Becerra’s Power to Penalize States Faces Scrutiny

Image Credit: Shutterstock / fizkes

The administration gave Health and Human Services (HHS) Secretary Xavier Becerra the authority to penalize states or put a stop to disenrollments in the event of identified improper removals.

Information Black Hole

Image Credit: Shutterstock / New Africa

However, HHS has shared scant information about the problems it has uncovered. Earlier this year, HHS briefly halted disenrollments in 14 states without disclosing specific details.

Children Wrongfully Removed

Image Credit: Shutterstock / aomas

In August, it was revealed that thousands of children had been wrongly removed in 29 states, prompting CMS to mandate the reinstatement of coverage for those affected.

Widespread Issues Persist for Disenrolled Medicaid Beneficiaries

Image Credit: Shutterstock / CCISUL

Despite these interventions, numerous advocates nationwide report widespread issues while assisting the estimated 10 million people who have already dropped out of Medicaid.

Critics Accuse HHS of Withholding Findings

Image Credit: Shutterstock / Prostock-studio

Concerns persist that systemic problems are being overlooked, and critics argue that HHS has not been transparent about its findings.

Avalere’s Projection

Image Credit: Shutterstock / fizkes

If current trends persist, Avalere projects that as many as 30 million people could lose Medicaid coverage.

This alarming figure far surpasses the Biden administration’s initial estimate of 15 million individuals facing disenrollment.

Systemic Problems in Medicaid Eligibility Determination

Image Credit: Shutterstock / fizkes

The reasons behind these removals are largely procedural, with individuals failing to return renewal forms or provide necessary paperwork.

This highlights systemic issues in how states determine Medicaid eligibility, with notices often failing to reach recipients or conveying confusing information.

Arkansas Anomaly – 70% Disenrolled Due to Procedural Issues

Image Credit: Shutterstock / Monster Ztudio

In Arkansas, over 70% of people were disenrolled due to procedural issues, raising serious concerns about the state’s notification process.

Florida’s Frustrations

Image Credit: Shutterstock / fizkes

Long phone wait times and unclear notices have plagued Florida’s Medicaid review, leading advocates to criticize CMS for its reluctance to address these issues.

Urgent Calls for Intervention as Systemic Issues Persist

Image Credit: Shutterstock / one photo

Despite the dire situation, CMS has not intervened to halt disenrollments in states like Arkansas, where procedural issues have resulted in significant removals.

Advocates argue that these problems go beyond anomalies and point to systemic issues that need immediate attention.

Americans on the Brink as Biden Administration Faces Medicaid Enrollments Crisis

Image Credit: Shutterstock / Gints Ivuskans

As states grapple with flawed reviews and individuals face the imminent loss of vital Medicaid coverage, the Biden administration finds itself under increasing scrutiny for its perceived inaction.

The health and well-being of millions of Americans hangs in the balance, emphasizing the urgency of addressing these systemic failures in the Medicaid enrollment process.

More From Thrifty Guardian

Thousands of Children of Illegal Immigrants May Be Deported: US Supreme Court Decides Fate of “Dreamers”

Ramaswamy Would End “Birthright Citizenship”: Believes Illegal Immigrants Should Be Deported as a Family Unit

The post Medicaid Enrollment Crisis Looms: Up to 30 Million Vulnerable Americans Face Disenrollment Due to Flawed State Reviews first appeared on Thrifty Guardian.

Featured Image Credit: Shutterstock / kenary820

by Joe Lysikatos | Finance Pulse

In a surprising turn of events, top European bank UBS is sounding the alarm, forecasting a looming recession for the United States in 2024. According to their recent analysis, this economic downturn is poised to trigger a substantial response from the Federal Reserve, with interest rate cuts that could be nearly four times more aggressive than what the market currently anticipates.

The Forecast: An Unprecedented 275 Basis Point Cut

Image Credit: Shutterstock / Comdas

UBS delivered a bold prediction, suggesting that the Federal Reserve will respond to the impending economic challenges with an unprecedented interest rate cut of 275 basis points (a way to measure small changes in interest rates, where one basis point equals 0.01%, making discussions about tiny shifts more straightforward).

Beyond Expectations.

Image Credit: Shutterstock / AJR_photo

This projection, revealed in a research note led by economist Arend Kapteyn and strategist Bhanu Baweja, far surpasses the market’s expectation of a 75-basis-point reduction, as indicated by the CME Group’s Fedwatch tool.

March 2024 Unveils Pronounced Fed Easing Cycle

Image Credit: Shutterstock / fizkes

Describing a key aspect of UBS’s forecast, the team noted, “One of the key features of UBS’s forecast is the very pronounced Fed easing cycle seen unfolding from March 2024 onwards.”

Economists Speak

Image Credit: Shutterstock / Ljupco Smokovski

They anticipate rates plummeting to a mere 1.25% in the first half of 2025, reflecting a strategic move by the Federal Reserve to counteract the anticipated recession slated for the second and third quarters of 2024.

Reasons Behind the Projections

Image Credit: Shutterstock / Cookie Studio

The UBS team attributed their forecast to a combination of falling inflation rates and a broader economic slowdown. The expected recession, they argue, will prompt the Federal Reserve to initiate this drastic easing cycle.

Fed’s Strategic Move

Image Credit: Shutterstock / Halfpoint

The easing cycle is seen as a preemptive measure to mitigate the impact of the economic downturn on both headline and core inflation.

From Tightening to Easing

Image Credit: Shutterstock / Inside Creative House

This comes on the heels of the Federal Reserve’s efforts since March 2022 to raise borrowing costs from near-zero to approximately 5.5%, aiming to curb soaring inflation.

Inflation Dynamics

Image Credit: Shutterstock / Deemerwha studio

Despite hitting a four-decade high of 9.1% in June of the previous year, inflation has started to cool. However, it remains significantly above the central bank’s 2% target.

U.S. Economic Landscape

Image Credit: Shutterstock / LightField Studios

The tightening campaign initiated by the Federal Reserve was expected to weigh on the economy. However, the United States has managed to avoid a recession thus far.

Robust Q3 Growth Contrasts With UBS’s Recession Warning

Image Credit: Shutterstock / beeboys

The third quarter of the year witnessed a robust expansion of 4.9% in the country’s gross domestic product, marking the highest growth rate in two years.

Job Market Resilience

Image Credit: Shutterstock / fizkes

The job market has also demonstrated resilience in the face of the Fed’s interest rate hikes.

Despite a slight uptick in the unemployment rate in recent months, it still hovers below 4%.

Conflicting Views

Image Credit: Shutterstock / Stasonych

The recent recession prediction by Kapteyn and Baweja appears to contradict an earlier outlook from UBS’s head of asset allocation for the Americas, Jason Draho.

UBS’s Jason Draho Envisions ‘Roaring ‘20s’ Amid U.S. Economic Resilience

Image Credit: Shutterstock / TheVisualsYouNeed

In a presentation earlier this month, Draho painted a different picture, suggesting that the surprising resilience of the U.S. economy in the current year could set the stage for a “roaring ’20s” period characterized by higher GDP growth, inflation, bond yields, and interest rates.

Eyes on the Fed

Image Credit: Shutterstock / Cast Of Thousands

As these conflicting views unfold, all eyes will be on the Federal Reserve’s actions in the coming months and how the U.S. economy navigates the challenges on the horizon.

Federal Reserve’s Dilemma

Image Credit: Shutterstock / insta_photos

UBS’s bold forecast, if realized, could reshape the economic landscape and have far-reaching implications for businesses, investors, and households across the nation. Stay tuned for updates as the situation evolves..

More From Thrifty Guardian

Thousands of Children of Illegal Immigrants May Be Deported: US Supreme Court Decides Fate of “Dreamers”

Ramaswamy Would End “Birthright Citizenship”: Believes Illegal Immigrants Should Be Deported as a Family Unit

The post Predicted Recession for the US in 2024, UBS Anticipating Drastic Interest Rate Cuts first appeared on Thrifty Guardian.

Featured Image Credit: Shutterstock / Michael Derrer Fuchs

by Joe Lysikatos | Finance Pulse

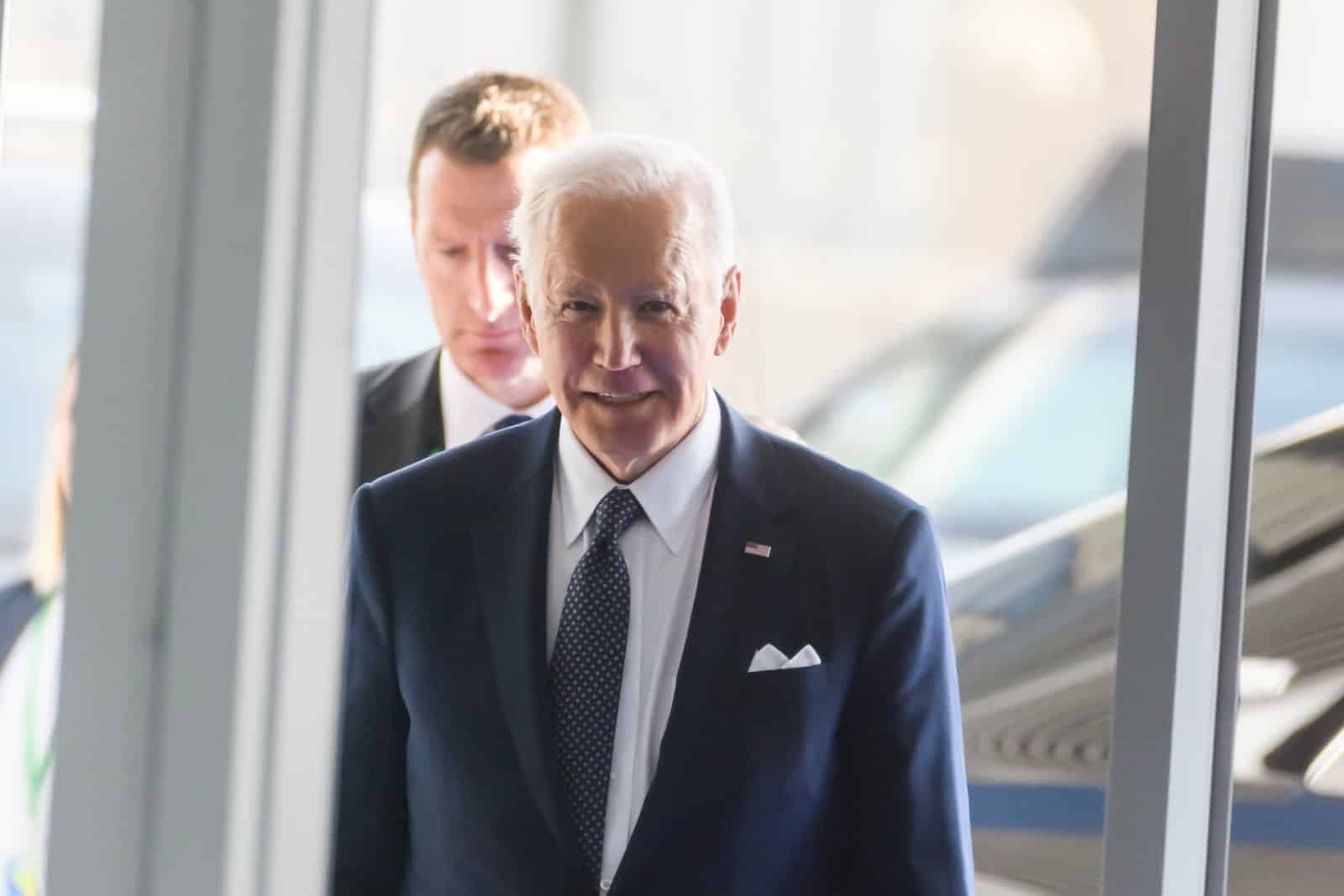

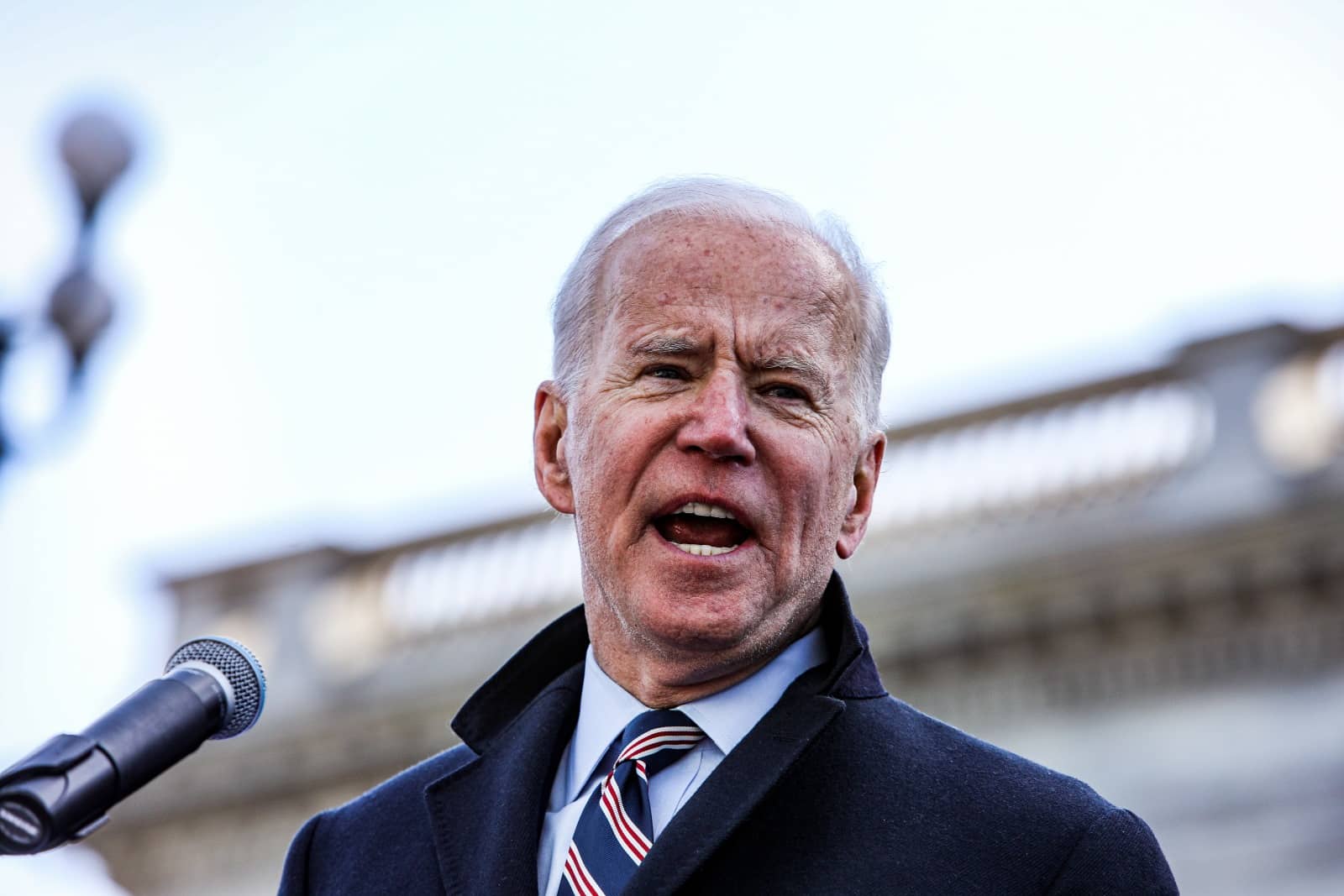

President Joe Biden sternly addressed corporations on Monday, accusing them of maintaining artificially high prices despite a slowdown in inflation and improved supply chains. Speaking at the launch of a new White House supply chain initiative, Biden called for an end to what he termed as “price gouging.”

Biden’s Stern Words

Image Credit: Shutterstock / Perry McLeod

“Any corporation that has not brought their prices back down, even as inflation has come down, even as the supply chains have been rebuilt, it’s time to stop the price gouging,” Biden asserted. “Give the American consumer a break.”

Inflation Dynamics

Image Credit: Shutterstock / Sauko Andrei

While the annual rate of inflation has indeed decreased from its peak last summer, it’s crucial to note that this doesn’t equate to a direct decline in consumer prices. Instead, it signifies a slower rate of price increase.

Thanksgiving Cost Relief

Image Credit: Shutterstock / Lightspring

Some everyday goods have seen a reduction in prices over the past year, leading to lower costs for events like Thanksgiving.

Black Friday Boost

Image Credit: Shutterstock / Roman Samborskyi

This, in turn, has left consumers with more disposable income for activities such as Black Friday shopping, where U.S. online sales rose 7.5% this past weekend compared to a year ago.

Bidenomics in Focus

Image Credit: Shutterstock / El Nariz

In the context of Biden’s reelection bid, the White House seeks to portray these broader spending and pricing trends as victories for Bidenomics.

A Public Sentiment Challenge

Image Credit: Shutterstock / Niyazz

However, convincing voters that Biden deserves credit for a robust economic recovery has proven challenging, as public sentiment consistently rates the president poorly on financial matters.

White House Acknowledges Concerns

Image Credit: Shutterstock / Michael Warwick

“We understand that people are still not feeling it, we get that,” acknowledged White House press secretary Karine Jean-Pierre, addressing the skepticism ahead of the president’s supply chain event.

Targeting “Junk Fees”

Image Credit: Shutterstock / ponsulak

Focusing on so-called “junk fees,” which Biden described as fees “companies sneak into your bill,” presents the White House with an opportunity to directly showcase the president’s actions on behalf of consumers. It also provides a convenient target in the ongoing blame game surrounding inflation.

Money Drains

Image Credit: Shutterstock / pathdoc

“Junk fees take real money out of the pockets of average Americans,” Biden emphasized. “They can add up to hundreds of dollars, weighing down family budgets and making it harder for families to pay their bills.” He expressed that consumers often feel deceived, stating, “They feel like they’re being played for suckers. Which they are.”

Post-Pandemic Price Surges

Image Credit: Shutterstock / d.ee_angelo

As the U.S. emerged from the Covid-19 pandemic, prices surged. According to the Bureau of Labor Statistics, in the two years starting from April 2021, the average price of all goods rose by 13%.

Food Price Shock

Image Credit: Shutterstock / Ljupco Smokovski

Average food prices during the same period saw a massive increase of 20%. These price hikes were driven by intense consumer demand, pandemic-related economic stimulus, and ongoing supply chain disruptions, putting significant strain on household budgets.

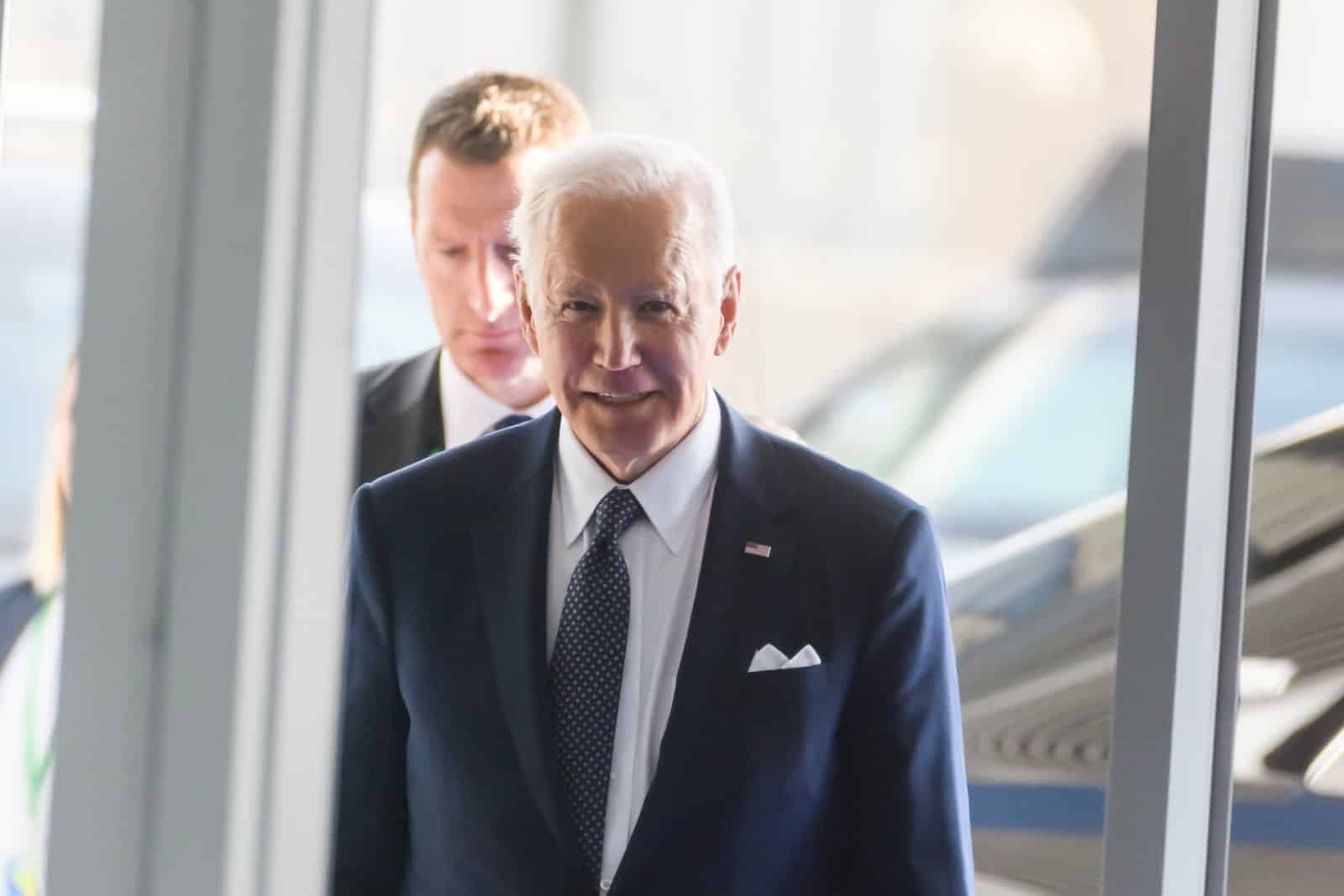

Biden’s Initiative to Tackle Supply Chain Challenges

Image Credit: Shutterstock / Alexandros Michailidis

To sustain the momentum of the economic recovery, President Biden launched the Supply Chain Resilience Council, which aims to address supply chain challenges and prevent future shortages of crucial products such as drugs and semiconductors.

30 Initiatives Announced

Image Credit: Shutterstock / TuiPhotoEngineer

Alongside the council’s establishment, Biden announced 30 initiatives to alleviate supply chain pressures.

A Battle Against Inflation

Image Credit: Shutterstock / FOTOGRIN

In the ongoing battle against inflation, Biden’s call to end “price gouging” and tackle “junk fees” is positioned as a direct effort to alleviate American households’ financial burdens and demonstrate tangible actions in response to economic challenges.

Observing the Effectiveness of Biden’s Economic Initiatives

Image Credit: Shutterstock / Consolidated News Photos

The effectiveness and impact of these initiatives on public perception remain key points of observation as the nation navigates its economic landscape.

More From Thrifty Guardian

Thousands of Children of Illegal Immigrants May Be Deported: US Supreme Court Decides Fate of “Dreamers”

Ramaswamy Would End “Birthright Citizenship”: Believes Illegal Immigrants Should Be Deported as a Family Unit

The post Biden Accuses Corporations of Price Hiking Amid Economic Recovery Efforts first appeared on Thrifty Guardian.

Featured Image Credit: Shutterstock / mark reinstein. The people shown in the images are for illustrative purposes only, not the actual people featured in the story.